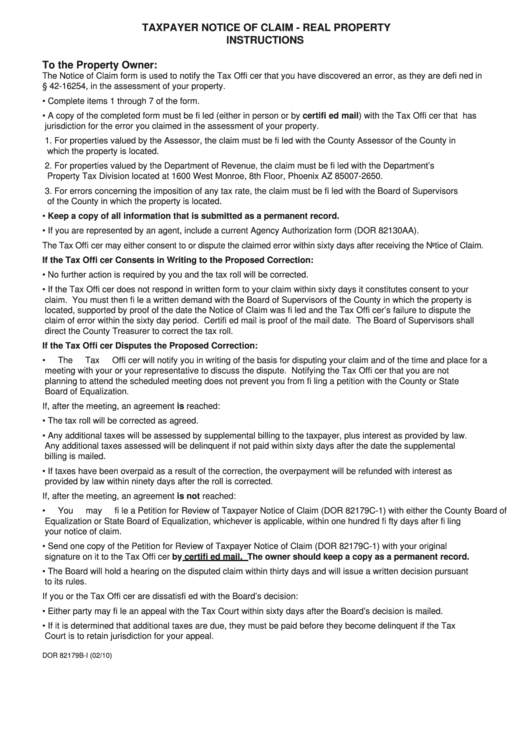

TAXPAYER NOTICE OF CLAIM - REAL PROPERTY

INSTRUCTIONS

To the Property Owner:

The Notice of Claim form is used to notify the Tax Offi cer that you have discovered an error, as they are defi ned in

A.R.S. § 42-16254, in the assessment of your property.

•

Complete items 1 through 7 of the form.

•

A copy of the completed form must be fi led (either in person or by certifi ed mail) with the Tax Offi cer that has

jurisdiction for the error you claimed in the assessment of your property.

1.

For properties valued by the Assessor, the claim must be fi led with the County Assessor of the County in

which the property is located.

2.

For properties valued by the Department of Revenue, the claim must be fi led with the Department’s

Property Tax Division located at 1600 West Monroe, 8th Floor, Phoenix AZ 85007-2650.

3.

For errors concerning the imposition of any tax rate, the claim must be fi led with the Board of Supervisors

of the County in which the property is located.

•

Keep a copy of all information that is submitted as a permanent record.

•

If you are represented by an agent, include a current Agency Authorization form (DOR 82130AA).

The Tax Offi cer may either consent to or dispute the claimed error within sixty days after receiving the Notice of Claim.

If the Tax Offi cer Consents in Writing to the Proposed Correction:

•

No further action is required by you and the tax roll will be corrected.

•

If the Tax Offi cer does not respond in written form to your claim within sixty days it constitutes consent to your

claim. You must then fi le a written demand with the Board of Supervisors of the County in which the property is

located, supported by proof of the date the Notice of Claim was fi led and the Tax Offi cer’s failure to dispute the

claim of error within the sixty day period. Certifi ed mail is proof of the mail date. The Board of Supervisors shall

direct the County Treasurer to correct the tax roll.

If the Tax Offi cer Disputes the Proposed Correction:

•

The Tax Offi cer will notify you in writing of the basis for disputing your claim and of the time and place for a

meeting with your or your representative to discuss the dispute. Notifying the Tax Offi cer that you are not

planning to attend the scheduled meeting does not prevent you from fi ling a petition with the County or State

Board of Equalization.

If, after the meeting, an agreement is reached:

•

The tax roll will be corrected as agreed.

•

Any additional taxes will be assessed by supplemental billing to the taxpayer, plus interest as provided by law.

Any additional taxes assessed will be delinquent if not paid within sixty days after the date the supplemental

billing is mailed.

•

If taxes have been overpaid as a result of the correction, the overpayment will be refunded with interest as

provided by law within ninety days after the roll is corrected.

If, after the meeting, an agreement is not reached:

•

You may fi le a Petition for Review of Taxpayer Notice of Claim (DOR 82179C-1) with either the County Board of

Equalization or State Board of Equalization, whichever is applicable, within one hundred fi fty days after fi ling

your notice of claim.

•

Send one copy of the Petition for Review of Taxpayer Notice of Claim (DOR 82179C-1) with your original

signature on it to the Tax Offi cer by certifi ed mail. The owner should keep a copy as a permanent record.

•

The Board will hold a hearing on the disputed claim within thirty days and will issue a written decision pursuant

to its rules.

If you or the Tax Offi cer are dissatisfi ed with the Board’s decision:

•

Either party may fi le an appeal with the Tax Court within sixty days after the Board’s decision is mailed.

•

If it is determined that additional taxes are due, they must be paid before they become delinquent if the Tax

Court is to retain jurisdiction for your appeal.

DOR 82179B-I (02/10)

1

1 2

2