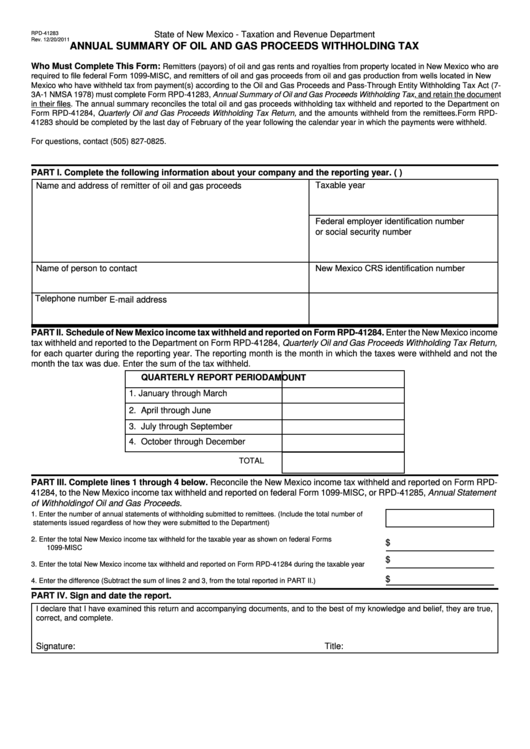

State of New Mexico - Taxation and Revenue Department

RPD-41283

Rev. 12/20/2011

ANNUAL SUMMARY OF OIL AND GAS PROCEEDS WITHHOLDING TAX

Remitters (payors) of oil and gas rents and royalties from property located in New Mexico who are

Who Must Complete This Form:

required to file federal Form 1099-MISC, and remitters of oil and gas proceeds from oil and gas production from wells located in New

Mexico who have withheld tax from payment(s) according to the Oil and Gas Proceeds and Pass-Through Entity Withholding Tax Act (7-

3A-1 NMSA 1978) must complete Form RPD-41283, Annual Summary of Oil and Gas Proceeds Withholding Tax, and retain the document

in their files. The annual summary reconciles the total oil and gas proceeds withholding tax withheld and reported to the Department on

Form RPD-41284, Quarterly Oil and Gas Proceeds Withholding Tax Return, and the amounts withheld from the remittees. Form RPD-

41283 should be completed by the last day of February of the year following the calendar year in which the payments were withheld.

For questions, contact (505) 827-0825.

PART I. Complete the following information about your company and the reporting year. (e.g. 2011)

Taxable year

Name and address of remitter of oil and gas proceeds

Federal employer identification number

or social security number

Name of person to contact

New Mexico CRS identification number

Telephone number

E-mail address

PART II. Schedule of New Mexico income tax withheld and reported on Form RPD-41284. Enter the New Mexico income

tax withheld and reported to the Department on Form RPD-41284, Quarterly Oil and Gas Proceeds Withholding Tax Return,

for each quarter during the reporting year. The reporting month is the month in which the taxes were withheld and not the

month the tax was due. Enter the sum of the tax withheld.

QUARTERLY REPORT PERIOD

AMOUNT

1. January through March

2. April through June

3. July through September

4. October through December

TOTAL

PART III. Complete lines 1 through 4 below. Reconcile the New Mexico income tax withheld and reported on Form RPD-

41284, to the New Mexico income tax withheld and reported on federal Form 1099-MISC, or RPD-41285, Annual Statement

of Withholding of Oil and Gas Proceeds.

1.

Enter the number of annual statements of withholding submitted to remittees. (Include the total number of

statements issued regardless of how they were submitted to the Department) ....................................................

2.

Enter the total New Mexico income tax withheld for the taxable year as shown on federal Forms

$

1099-MISC ............................................................................................................................................................

$

3.

Enter the total New Mexico income tax withheld and reported on Form RPD-41284 during the taxable year ......

$

4.

Enter the difference (Subtract the sum of lines 2 and 3, from the total reported in PART II.) ................................

PART IV. Sign and date the report.

I declare that I have examined this return and accompanying documents, and to the best of my knowledge and belief, they are true,

correct, and complete.

Signature:

Title:

Date:

1

1 2

2