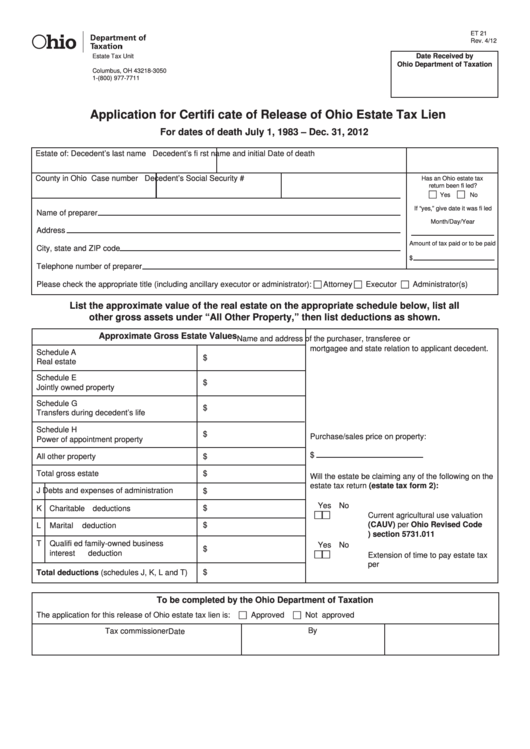

ET 21

Rev. 4/12

Reset Form

Date Received by

Estate Tax Unit

P.O. Box 183050

Ohio Department of Taxation

Columbus, OH 43218-3050

1-(800) 977-7711

tax.ohio.gov

Application for Certifi cate of Release of Ohio Estate Tax Lien

For dates of death July 1, 1983 – Dec. 31, 2012

Estate of: Decedent’s last name

Decedent’s fi rst name and initial

Date of death

County in Ohio

Case number

Decedent’s Social Security #

Has an Ohio estate tax

return been fi led?

Yes

No

If “yes,” give date it was fi led

Name of preparer

Month/Day/Year

Address

Amount of tax paid or to be paid

City, state and ZIP code

$

Telephone number of preparer

Attorney

Executor Administrator(s)

Please check the appropriate title (including ancillary executor or administrator):

List the approximate value of the real estate on the appropriate schedule below, list all

other gross assets under “All Other Property,” then list deductions as shown.

Approximate Gross Estate Values

Name and address of the purchaser, transferee or

mortgagee and state relation to applicant decedent.

Schedule A

$

Real estate

Schedule E

$

Jointly owned property

Schedule G

$

Transfers during decedent’s life

Schedule H

$

Purchase/sales price on property:

Power of appointment property

$

All other property

$

Total gross estate

$

Will the estate be claiming any of the following on the

estate tax return (estate tax form 2):

J

Debts and expenses of administration

$

Yes

No

$

K Charitable deductions

Current agricultural use valuation

$

(CAUV) per Ohio Revised Code

L

Marital deduction

R.C.) section 5731.011

T

Qualifi ed family-owned business

Yes

No

$

interest deduction

Extension of time to pay estate tax

per R.C. section 5731.25

$

Total deductions (schedules J, K, L and T)

To be completed by the Ohio Department of Taxation

Approved

Not approved

The application for this release of Ohio estate tax lien is:

Tax commissioner

By

Date

1

1 2

2