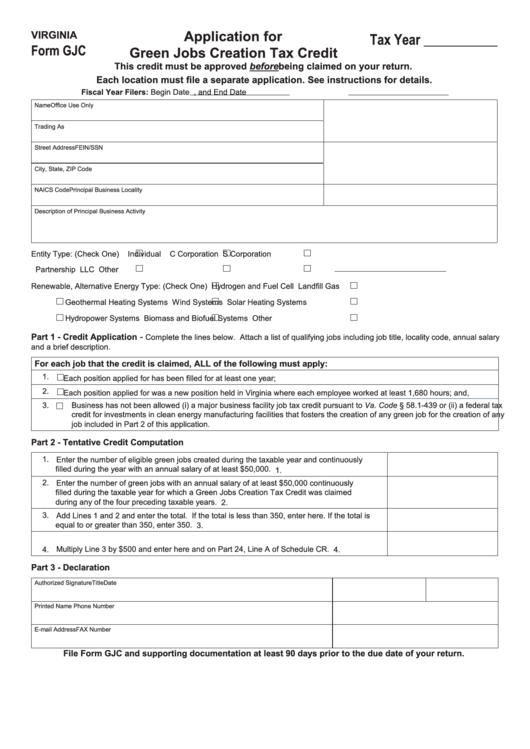

Form Gjc - Virginia Application For Green Jobs Creation Tax Credit

ADVERTISEMENT

Application for

VIRGINIA

Tax Year ___________

Form GJC

Green Jobs Creation Tax Credit

This credit must be approved before being claimed on your return.

Each location must file a separate application. See instructions for details.

Fiscal Year Filers: Begin Date

, and End Date

Name

Office Use Only

Trading As

Street Address

FEIN/SSN

City, State, ZIP Code

NAICS Code

Principal Business Locality

Description of Principal Business Activity

Entity Type: (Check One)

Individual

C Corporation

S Corporation

Partnership

LLC

Other

Renewable, Alternative Energy Type: (Check One)

Hydrogen and Fuel Cell

Landfill Gas

Geothermal Heating Systems

Wind Systems

Solar Heating Systems

Hydropower Systems

Biomass and Biofuel Systems

Other

-

Part 1 - Credit Application

Complete the lines below. Attach a list of qualifying jobs including job title, locality code, annual salary

and a brief description.

For each job that the credit is claimed, ALL of the following must apply:

1.

Each position applied for has been filled for at least one year;

2.

Each position applied for was a new position held in Virginia where each employee worked at least 1,680 hours; and,

3.

Business has not been allowed (i) a major business facility job tax credit pursuant to Va. Code § 58.1-439 or (ii) a federal tax

credit for investments in clean energy manufacturing facilities that fosters the creation of any green job for the creation of any

job included in Part 2 of this application.

Part 2 - Tentative Credit Computation

1. Enter the number of eligible green jobs created during the taxable year and continuously

filled during the year with an annual salary of at least $50,000. ...........................................

1.

2. Enter the number of green jobs with an annual salary of at least $50,000 continuously

filled during the taxable year for which a Green Jobs Creation Tax Credit was claimed

during any of the four preceding taxable years. ...................................................................

2.

3. Add Lines 1 and 2 and enter the total. If the total is less than 350, enter here. If the total is

equal to or greater than 350, enter 350. ..............................................................................

3.

4. Multiply Line 3 by $500 and enter here and on Part 24, Line A of Schedule CR. ................

4.

Part 3 - Declaration

Authorized Signature

Title

Date

Printed Name

Phone Number

E-mail Address

FAX Number

File Form GJC and supporting documentation at least 90 days prior to the due date of your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3