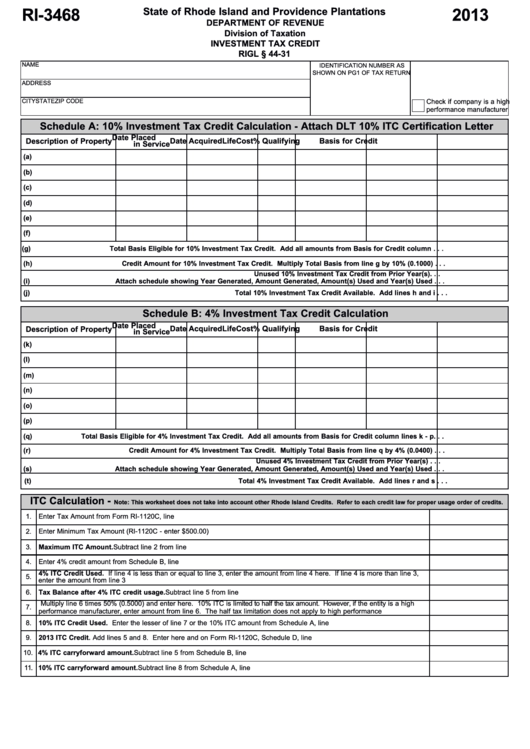

State of Rhode Island and Providence Plantations

RI-3468

2013

DEPARTMENT OF REVENUE

Division of Taxation

INVESTMENT TAX CREDIT

RIGL § 44-31

NAME

IDENTIFICATION NUMBER AS

U.S. BUSINESS CODE NUMBER

SHOWN ON PG1 OF TAX RETURN

ADDRESS

CITY

STATE

ZIP CODE

Check if company is a high

performance manufacturer

Schedule A: 10% Investment Tax Credit Calculation - Attach DLT 10% ITC Certification Letter

Date Placed

Description of Property

Date Acquired

Life

Cost

% Qualifying

Basis for Credit

in Service

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Total Basis Eligible for 10% Investment Tax Credit. Add all amounts from Basis for Credit column . . .

(h)

Credit Amount for 10% Investment Tax Credit. Multiply Total Basis from line g by 10% (0.1000) . . .

Unused 10% Investment Tax Credit from Prior Year(s). . .

(i)

Attach schedule showing Year Generated, Amount Generated, Amount(s) Used and Year(s) Used . . .

(j)

Total 10% Investment Tax Credit Available. Add lines h and i . . .

Schedule B: 4% Investment Tax Credit Calculation

Date Placed

Description of Property

Date Acquired

Life

Cost

% Qualifying

Basis for Credit

in Service

(k)

(l)

(m)

(n)

(o)

(p)

(q)

Total Basis Eligible for 4% Investment Tax Credit. Add all amounts from Basis for Credit column lines k - p. . .

(r)

Credit Amount for 4% Investment Tax Credit. Multiply Total Basis from line q by 4% (0.0400) . . .

Unused 4% Investment Tax Credit from Prior Year(s) . . .

(s)

Attach schedule showing Year Generated, Amount Generated, Amount(s) Used and Year(s) Used . . .

(t)

Total 4% Investment Tax Credit Available. Add lines r and s . . .

ITC Calculation -

Note: This worksheet does not take into account other Rhode Island Credits. Refer to each credit law for proper usage order of credits.

1.

Enter Tax Amount from Form RI-1120C, line 13...................................................................................................................................

2.

Enter Minimum Tax Amount (RI-1120C - enter $500.00)......................................................................................................................

3.

Maximum ITC Amount. Subtract line 2 from line 1............................................................................................................................

4.

Enter 4% credit amount from Schedule B, line t...................................................................................................................................

4% ITC Credit Used. If line 4 is less than or equal to line 3, enter the amount from line 4 here. If line 4 is more than line 3,

5.

enter the amount from line 3 here.........................................................................................................................................................

6.

Tax Balance after 4% ITC credit usage. Subtract line 5 from line 3.................................................................................................

Multiply line 6 times 50% (0.5000) and enter here. 10% ITC is limited to half the tax amount. However, if the entity is a high

7.

performance manufacturer, enter amount from line 6. The half tax limitation does not apply to high performance manufacturers...

8.

10% ITC Credit Used. Enter the lesser of line 7 or the 10% ITC amount from Schedule A, line j.....................................................

9.

2013 ITC Credit. Add lines 5 and 8. Enter here and on Form RI-1120C, Schedule D, line 14A.......................................................

10. 4% ITC carryforward amount. Subtract line 5 from Schedule B, line t.............................................................................................

11. 10% ITC carryforward amount. Subtract line 8 from Schedule A, line j............................................................................................

1

1 2

2