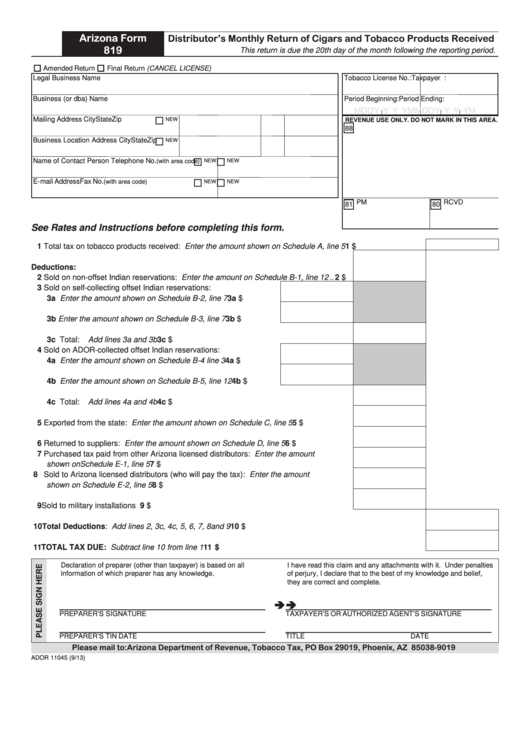

Arizona Form

Distributor’s Monthly Return of Cigars and Tobacco Products Received

819

This return is due the 20th day of the month following the reporting period.

Amended Return

Final Return (CANCEL LICENSE)

Legal Business Name

Tobacco License No.:

Taxpayer I.D. No.:

Business (or dba) Name

Period Beginning:

Period Ending:

M

M D D Y Y Y Y

M

M D D Y Y Y Y

Mailing Address

City

State Zip

NEW

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Business Location Address

City

State Zip

NEW

Name of Contact Person

Telephone No.

NEW

(with area code)

NEW

E-mail Address

Fax No.

NEW

(with area code)

NEW

81 PM

80 RCVD

See Rates and Instructions before completing this form.

1 Total tax on tobacco products received: Enter the amount shown on Schedule A, line 5 .............................

1 $

Deductions:

2 Sold on non-offset Indian reservations: Enter the amount on Schedule B-1, line 12 .. 2 $

3 Sold on self-collecting offset Indian reservations:

3a Enter the amount shown on Schedule B-2, line 7 ................. 3a $

3b Enter the amount shown on Schedule B-3, line 7 ................. 3b $

3c Total: Add lines 3a and 3b ..................................................................................... 3c $

4 Sold on ADOR-collected offset Indian reservations:

4a Enter the amount shown on Schedule B-4 line 3 .................. 4a $

4b Enter the amount shown on Schedule B-5, line 12 ............... 4b $

4c Total: Add lines 4a and 4b ..................................................................................... 4c $

5 Exported from the state: Enter the amount shown on Schedule C, line 5 ................... 5 $

6 Returned to suppliers: Enter the amount shown on Schedule D, line 5 ...................... 6 $

7 Purchased tax paid from other Arizona licensed distributors: Enter the amount

shown on Schedule E-1, line 5 ..................................................................................... 7 $

8 Sold to Arizona licensed distributors (who will pay the tax): Enter the amount

shown on Schedule E-2, line 5 ..................................................................................... 8 $

9 Sold to military installations .......................................................................................... 9 $

10 Total Deductions: Add lines 2, 3c, 4c, 5, 6, 7, 8 and 9 ................................................................................ 10 $

11 TOTAL TAX DUE: Subtract line 10 from line 1 ............................................................................................. 11 $

Declaration of preparer (other than taxpayer) is based on all

I have read this claim and any attachments with it. Under penalties

information of which preparer has any knowledge.

of perjury, I declare that to the best of my knowledge and belief,

they are correct and complete.

PREPARER’S SIGNATURE

TAXPAYER’S OR AUTHORIZED AGENT’S SIGNATURE

PREPARER’S TIN

DATE

TITLE

DATE

Please mail to: Arizona Department of Revenue, Tobacco Tax, PO Box 29019, Phoenix, AZ 85038-9019

ADOR 11045 (9/13)

1

1