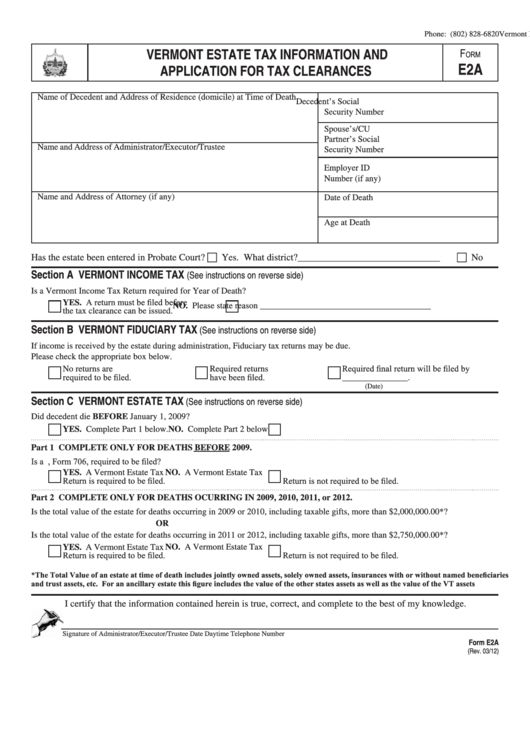

Form E2a - Vermont Estate Tax Information And Application For Tax Clearances

ADVERTISEMENT

Vermont Department of Taxes 133 State Street

Montpelier, VT 05633-1401

Phone: (802) 828-6820

VERMONT ESTATE TAX INFORMATION AND

F

orm

E2A

APPLICATION FOR TAX CLEARANCES

Name of Decedent and Address of Residence (domicile) at Time of Death

Decedent’s Social

Security Number

Spouse’s/CU

Partner’s Social

Name and Address of Administrator/Executor/Trustee

Security Number

Employer ID

Number (if any)

Name and Address of Attorney (if any)

Date of Death

Age at Death

Yes. What district?______________________________

No

Has the estate been entered in Probate Court?

Section A

VERMONT INCOME TAX

(See instructions on reverse side)

Is a Vermont Income Tax Return required for Year of Death?

YES. A return must be filed before

NO. Please state reason _______________________________________

the tax clearance can be issued.

Section B

VERMONT FIDUCIARY TAX

(See instructions on reverse side)

If income is received by the estate during administration, Fiduciary tax returns may be due.

Please check the appropriate box below.

Required final return will be filed by

No returns are

Required returns

required to be filed.

have been filed.

_______________.

(Date)

Section C

VERMONT ESTATE TAX

(See instructions on reverse side)

Did decedent die BEFORE January 1, 2009?

YES. Complete Part 1 below.

NO. Complete Part 2 below.

Part 1 COMPLETE ONLY FOR DEATHS BEFORE 2009.

Is a U.S. Estate Tax Return, Form 706, required to be filed?

YES. A Vermont Estate Tax

NO. A Vermont Estate Tax

Return is required to be filed.

Return is not required to be filed.

Part 2 COMPLETE ONLY FOR DEATHS OCURRING IN 2009, 2010, 2011, or 2012.

Is the total value of the estate for deaths occurring in 2009 or 2010, including taxable gifts, more than $2,000,000.00*?

OR

Is the total value of the estate for deaths occurring in 2011 or 2012, including taxable gifts, more than $2,750,000.00*?

YES. A Vermont Estate Tax

NO. A Vermont Estate Tax

Return is required to be filed.

Return is not required to be filed.

*The Total Value of an estate at time of death includes jointly owned assets, solely owned assets, insurances with or without named beneficiaries

and trust assets, etc. For an ancillary estate this figure includes the value of the other states assets as well as the value of the VT assets

I certify that the information contained herein is true, correct, and complete to the best of my knowledge.

Signature of Administrator/Executor/Trustee

Date

Daytime Telephone Number

Form E2A

(Rev. 03/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2