Instructions For Form Dr-309634n - Local Government User Of Diesel Fuel Tax Return - 2015

ADVERTISEMENT

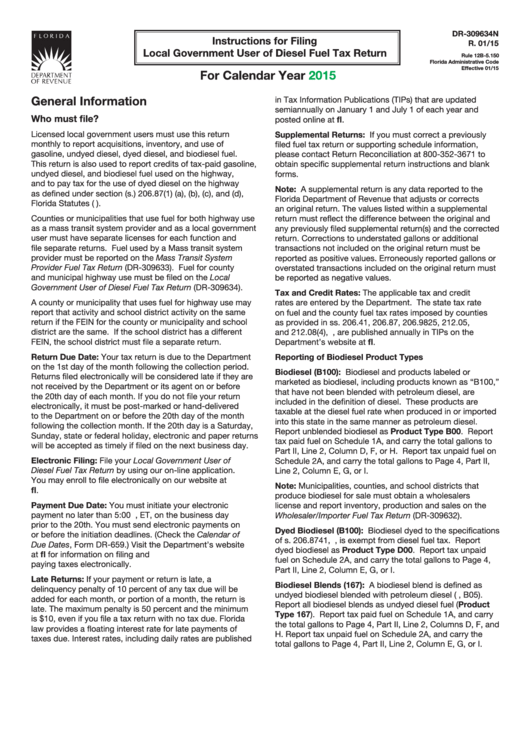

DR-309634N

Instructions for Filing

R. 01/15

Local Government User of Diesel Fuel Tax Return

Rule 12B-5.150

Florida Administrative Code

Effective 01/15

For Calendar Year

2015

General Information

in Tax Information Publications (TIPs) that are updated

semiannually on January 1 and July 1 of each year and

Who must file?

posted online at

Licensed local government users must use this return

Supplemental Returns: If you must correct a previously

monthly to report acquisitions, inventory, and use of

filed fuel tax return or supporting schedule information,

gasoline, undyed diesel, dyed diesel, and biodiesel fuel.

please contact Return Reconciliation at 800-352-3671 to

This return is also used to report credits of tax-paid gasoline,

obtain specific supplemental return instructions and blank

undyed diesel, and biodiesel fuel used on the highway,

forms.

and to pay tax for the use of dyed diesel on the highway

Note: A supplemental return is any data reported to the

as defined under section (s.) 206.87(1) (a), (b), (c), and (d),

Florida Department of Revenue that adjusts or corrects

Florida Statutes (F.S.).

an original return. The values listed within a supplemental

Counties or municipalities that use fuel for both highway use

return must reflect the difference between the original and

as a mass transit system provider and as a local government

any previously filed supplemental return(s) and the corrected

user must have separate licenses for each function and

return. Corrections to understated gallons or additional

file separate returns. Fuel used by a Mass transit system

transactions not included on the original return must be

provider must be reported on the Mass Transit System

reported as positive values. Erroneously reported gallons or

Provider Fuel Tax Return (DR-309633). Fuel for county

overstated transactions included on the original return must

and municipal highway use must be filed on the Local

be reported as negative values.

Government User of Diesel Fuel Tax Return (DR-309634).

Tax and Credit Rates: The applicable tax and credit

A county or municipality that uses fuel for highway use may

rates are entered by the Department. The state tax rate

report that activity and school district activity on the same

on fuel and the county fuel tax rates imposed by counties

return if the FEIN for the county or municipality and school

as provided in ss. 206.41, 206.87, 206.9825, 212.05,

district are the same. If the school district has a different

and 212.08(4), F.S., are published annually in TIPs on the

FEIN, the school district must file a separate return.

Department’s website at

Return Due Date: Your tax return is due to the Department

Reporting of Biodiesel Product Types

on the 1st day of the month following the collection period.

Biodiesel (B100): Biodiesel and products labeled or

Returns filed electronically will be considered late if they are

marketed as biodiesel, including products known as “B100,”

not received by the Department or its agent on or before

that have not been blended with petroleum diesel, are

the 20th day of each month. If you do not file your return

included in the definition of diesel. These products are

electronically, it must be post-marked or hand-delivered

taxable at the diesel fuel rate when produced in or imported

to the Department on or before the 20th day of the month

into this state in the same manner as petroleum diesel.

following the collection month. If the 20th day is a Saturday,

Report unblended biodiesel as Product Type B00. Report

Sunday, state or federal holiday, electronic and paper returns

tax paid fuel on Schedule 1A, and carry the total gallons to

will be accepted as timely if filed on the next business day.

Part II, Line 2, Column D, F, or H. Report tax unpaid fuel on

Electronic Filing: File your Local Government User of

Schedule 2A, and carry the total gallons to Page 4, Part II,

Diesel Fuel Tax Return by using our on-line application.

Line 2, Column E, G, or I.

You may enroll to file electronically on our website at

Note: Municipalities, counties, and school districts that

produce biodiesel for sale must obtain a wholesalers

Payment Due Date: You must initiate your electronic

license and report inventory, production and sales on the

payment no later than 5:00 p.m., ET, on the business day

Wholesaler/Importer Fuel Tax Return (DR-309632).

prior to the 20th. You must send electronic payments on

Dyed Biodiesel (B100): Biodiesel dyed to the specifications

or before the initiation deadlines. (Check the Calendar of

of s. 206.8741, F.S., is exempt from diesel fuel tax. Report

Due Dates, Form DR-659.) Visit the Department’s website

dyed biodiesel as Product Type D00. Report tax unpaid

at for information on filing and

fuel on Schedule 2A, and carry the total gallons to Page 4,

paying taxes electronically.

Part II, Line 2, Column E, G, or I.

Late Returns: If your payment or return is late, a

Biodiesel Blends (167): A biodiesel blend is defined as

delinquency penalty of 10 percent of any tax due will be

undyed biodiesel blended with petroleum diesel (i.e., B05).

added for each month, or portion of a month, the return is

Report all biodiesel blends as undyed diesel fuel (Product

late. The maximum penalty is 50 percent and the minimum

Type 167). Report tax paid fuel on Schedule 1A, and carry

is $10, even if you file a tax return with no tax due. Florida

the total gallons to Page 4, Part II, Line 2, Columns D, F, and

law provides a floating interest rate for late payments of

H. Report tax unpaid fuel on Schedule 2A, and carry the

taxes due. Interest rates, including daily rates are published

total gallons to Page 4, Part II, Line 2, Column E, G, or I.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4