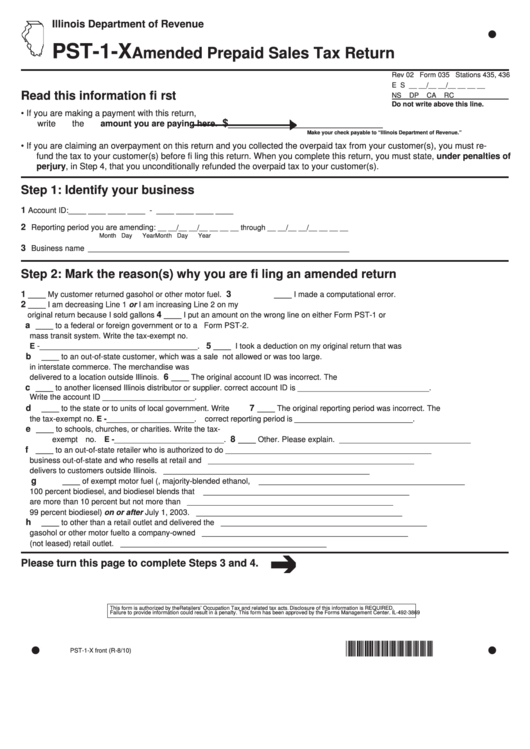

Illinois Department of Revenue

PST-1-X

Amended Prepaid Sales Tax Return

Rev 02 Form 035 Stations 435, 436

E S __ __/__ __/__ __ __ __

Read this information fi rst

NS

DP

CA

RC

Do not write above this line.

•

If you are making a payment with this return,

$___________________________

write the amount you are paying here.

Make your check payable to “Illinois Department of Revenue.”

•

If you are claiming an overpayment on this return and you collected the overpaid tax from your customer(s), you must re-

fund the tax to your customer(s) before fi ling this return. When you complete this return, you must state, under penalties of

perjury, in Step 4, that you unconditionally refunded the overpaid tax to your customer(s).

Step 1: Identify your business

1

Account ID: ____ ____ ____ ____ - ____ ____ ____ ____

2

Reporting period you are amending:

__ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month Day

Year

Month Day

Year

3

Business name ___________________________________________________________

Step 2: Mark the reason(s) why you are fi ling an amended return

1

3

____ My customer returned gasohol or other motor fuel.

____ I made a computational error.

2

____ I am decreasing Line 1 or I am increasing Line 2 on my

4

original return because I sold gallons

____ I put an amount on the wrong line on either Form PST-1 or

a

____ to a federal or foreign government or to a

Form PST-2.

mass transit system. Write the tax-exempt no.

5

E -____________________________________.

____ I took a deduction on my original return that was

b

____ to an out-of-state customer, which was a sale

not allowed or was too large.

in interstate commerce. The merchandise was

6

delivered to a location outside Illinois.

____ The original account ID was incorrect. The

c

____ to another licensed Illinois distributor or supplier.

correct account ID is ______________________________.

Write the account ID _____________________.

d

7

____ to the state or to units of local government. Write

____ The original reporting period was incorrect. The

the tax-exempt no. E -____________________.

correct reporting period is ___________________________.

e

____ to schools, churches, or charities. Write the tax-

8

exempt no. E -_________________________.

____ Other. Please explain. ______________________________

f

____ to an out-of-state retailer who is authorized to do

_______________________________________________

business out-of-state and who resells at retail and

_______________________________________________

delivers to customers outside Illinois.

_______________________________________________

g

____ of exempt motor fuel (i.e., majority-blended ethanol,

_______________________________________________

100 percent biodiesel, and biodiesel blends that

_______________________________________________

are more than 10 percent but not more than

_______________________________________________

99 percent biodiesel) on or after July 1, 2003.

_______________________________________________

h

____ to other than a retail outlet and delivered the

_______________________________________________

gasohol or other motor fuel to a company-owned

_______________________________________________

(not leased) retail outlet.

_______________________________________________

Please turn this page to complete Steps 3 and 4.

This form is authorized by the Retailers’ Occupation Tax and related tax

acts.

Disclosure of this information is REQUIRED.

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3869

*003521110*

PST-1-X front (R-8/10)

1

1 2

2