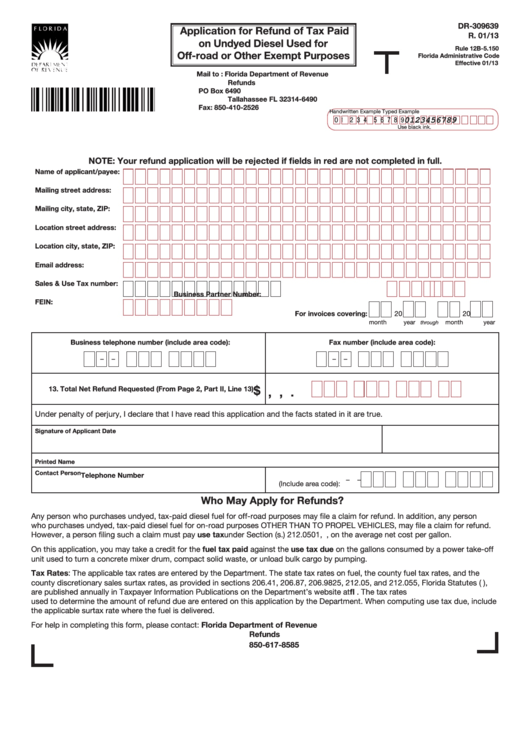

Form Dr-309639 - Application For Refund Of Tax Paid On Undyed Diesel Used For Off-Road Or Other Exempt Purposes

ADVERTISEMENT

DR-309639

Application for Refund of Tax Paid

R. 01/13

on Undyed Diesel Used for

Rule 12B-5.150

Off-road or Other Exempt Purposes

Florida Administrative Code

Effective 01/13

Mail to : Florida Department of Revenue

Refunds

PO Box 6490

Tallahassee FL 32314-6490

Fax: 850-410-2526

Handwritten Example

Typed Example

0 1

2 3 4 5 6 7 8 9

0123456789

Use black ink.

NOTE: Your refund application will be rejected if fields in red are not completed in full.

Name of applicant/payee:

Mailing street address:

Mailing city, state, ZIP:

Location street address:

Location city, state, ZIP:

Email address:

Sales & Use Tax number:

Business Partner Number:

FEIN:

For invoices covering:

20

20

month

year

month

year

through

Business telephone number (include area code):

Fax number (include area code):

–

–

–

–

$

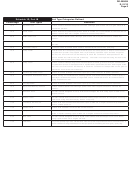

13. Total Net Refund Requested (From Page 2, Part II, Line 13)

,

,

.

Under penalty of perjury, I declare that I have read this application and the facts stated in it are true.

Signature of Applicant

Date

Printed Name

Contact Person

Telephone Number

–

–

(Include area code):

Who May Apply for Refunds?

Any person who purchases undyed, tax-paid diesel fuel for off-road purposes may file a claim for refund. In addition, any person

who purchases undyed, tax-paid diesel fuel for on-road purposes OTHER THAN TO PROPEL VEHICLES, may file a claim for refund.

However, a person filing such a claim must pay use tax under Section (s.) 212.0501, F.S., on the average net cost per gallon.

On this application, you may take a credit for the fuel tax paid against the use tax due on the gallons consumed by a power take-off

unit used to turn a concrete mixer drum, compact solid waste, or unload bulk cargo by pumping.

Tax Rates: The applicable tax rates are entered by the Department. The state tax rates on fuel, the county fuel tax rates, and the

county discretionary sales surtax rates, as provided in sections 206.41, 206.87, 206.9825, 212.05, and 212.055, Florida Statutes (F.S.),

are published annually in Taxpayer Information Publications on the Department’s website at The tax rates

used to determine the amount of refund due are entered on this application by the Department. When computing use tax due, include

the applicable surtax rate where the fuel is delivered.

For help in completing this form, please contact:

Florida Department of Revenue

Refunds

850-617-8585

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10