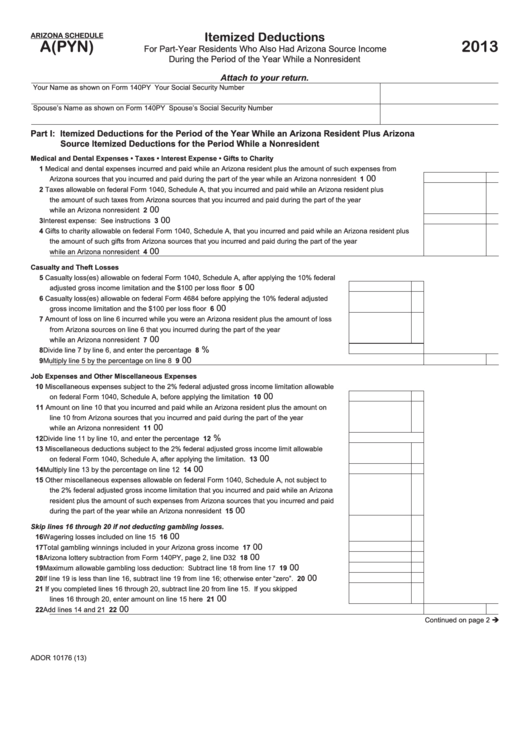

Itemized Deductions

ARIZONA SCHEDULE

A(PYN)

2013

For Part-Year Residents Who Also Had Arizona Source Income

During the Period of the Year While a Nonresident

Attach to your return.

Your Name as shown on Form 140PY

Your Social Security Number

Spouse’s Name as shown on Form 140PY

Spouse’s Social Security Number

Part I: Itemized Deductions for the Period of the Year While an Arizona Resident Plus Arizona

Source Itemized Deductions for the Period While a Nonresident

Medical and Dental Expenses • Taxes • Interest Expense • Gifts to Charity

1 Medical and dental expenses incurred and paid while an Arizona resident plus the amount of such expenses from

00

Arizona sources that you incurred and paid during the part of the year while an Arizona nonresident .............................. 1

2 Taxes allowable on federal Form 1040, Schedule A, that you incurred and paid while an Arizona resident plus

the amount of such taxes from Arizona sources that you incurred and paid during the part of the year

00

while an Arizona nonresident .............................................................................................................................................. 2

00

3 Interest expense: See instructions ..................................................................................................................................... 3

4 Gifts to charity allowable on federal Form 1040, Schedule A, that you incurred and paid while an Arizona resident plus

the amount of such gifts from Arizona sources that you incurred and paid during the part of the year

00

while an Arizona nonresident .............................................................................................................................................. 4

Casualty and Theft Losses

5 Casualty loss(es) allowable on federal Form 1040, Schedule A, after applying the 10% federal

00

adjusted gross income limitation and the $100 per loss floor ...................................................... 5

6 Casualty loss(es) allowable on federal Form 4684 before applying the 10% federal adjusted

00

gross income limitation and the $100 per loss floor ..................................................................... 6

7 Amount of loss on line 6 incurred while you were an Arizona resident plus the amount of loss

from Arizona sources on line 6 that you incurred during the part of the year

00

while an Arizona nonresident ....................................................................................................... 7

%

8 Divide line 7 by line 6, and enter the percentage ......................................................................... 8

00

9 Multiply line 5 by the percentage on line 8 .......................................................................................................................... 9

Job Expenses and Other Miscellaneous Expenses

10 Miscellaneous expenses subject to the 2% federal adjusted gross income limitation allowable

00

on federal Form 1040, Schedule A, before applying the limitation .............................................. 10

11 Amount on line 10 that you incurred and paid while an Arizona resident plus the amount on

line 10 from Arizona sources that you incurred and paid during the part of the year

00

while an Arizona nonresident ....................................................................................................... 11

%

12 Divide line 11 by line 10, and enter the percentage ..................................................................... 12

13 Miscellaneous deductions subject to the 2% federal adjusted gross income limit allowable

00

on federal Form 1040, Schedule A, after applying the limitation. ................................................ 13

00

14 Multiply line 13 by the percentage on line 12 ............................................................................... 14

15 Other miscellaneous expenses allowable on federal Form 1040, Schedule A, not subject to

the 2% federal adjusted gross income limitation that you incurred and paid while an Arizona

resident plus the amount of such expenses from Arizona sources that you incurred and paid

00

during the part of the year while an Arizona nonresident ............................................................. 15

Skip lines 16 through 20 if not deducting gambling losses.

00

16 Wagering losses included on line 15 ........................................................................................... 16

00

17 Total gambling winnings included in your Arizona gross income ................................................. 17

00

18 Arizona lottery subtraction from Form 140PY, page 2, line D32 .................................................. 18

00

19 Maximum allowable gambling loss deduction: Subtract line 18 from line 17 .............................. 19

00

20 If line 19 is less than line 16, subtract line 19 from line 16; otherwise enter “zero”. .................... 20

21 If you completed lines 16 through 20, subtract line 20 from line 15. If you skipped

00

lines 16 through 20, enter amount on line 15 here ...................................................................... 21

00

22 Add lines 14 and 21 ............................................................................................................................................................ 22

Continued on page 2

ADOR 10176 (13)

1

1 2

2