Certificate of Accuracy for IRS Individual

W-7(COA)

Form

OMB Number

Taxpayer Identification Number

(Rev. November 2011)

1545-0074

►

See Publication 4520

Department of the Treasury

►

Form use only by IRS Certifying Acceptance Agents when submitting Form W-7

Internal Revenue Service

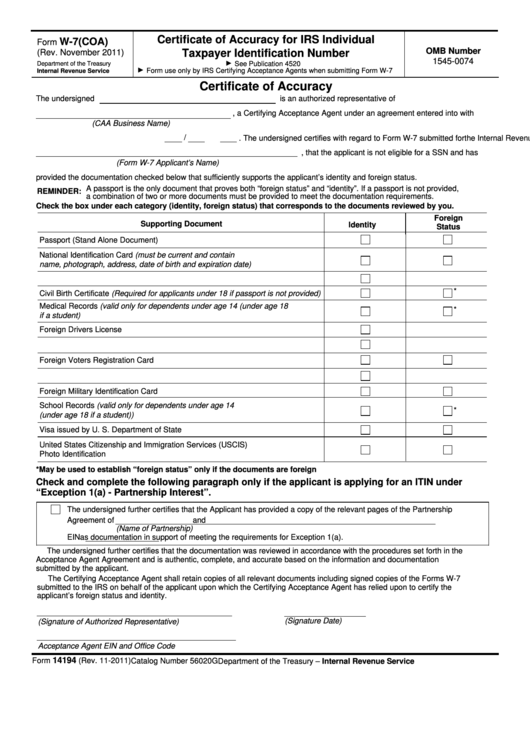

Certificate of Accuracy

The undersigned

is an authorized representative of

, a Certifying Acceptance Agent under an agreement entered into with

(CAA Business Name)

/20

/

the Internal Revenue Service dated

. The undersigned certifies with regard to Form W-7 submitted for

, that the applicant is not eligible for a SSN and has

(Form W-7 Applicant’s Name)

provided the documentation checked below that sufficiently supports the applicant’s identity and foreign status.

A passport is the only document that proves both “foreign status” and “identity”. If a passport is not provided,

REMINDER:

a combination of two or more documents must be provided to meet the documentation requirements.

Check the box under each category (identity, foreign status) that corresponds to the documents reviewed by you.

Foreign

Supporting Document

Identity

Status

Passport (Stand Alone Document)

National Identification Card (must be current and contain

name, photograph, address, date of birth and expiration date)

U.S. Drivers License

*

Civil Birth Certificate (Required for applicants under 18 if passport is not provided)

Medical Records (valid only for dependents under age 14 (under age 18

*

if a student)

Foreign Drivers License

U.S. State Identification Card

Foreign Voters Registration Card

U.S. Military Identification Card

Foreign Military Identification Card

School Records (valid only for dependents under age 14

*

(under age 18 if a student))

Visa issued by U. S. Department of State

United States Citizenship and Immigration Services (USCIS)

Photo Identification

*May be used to establish “foreign status” only if the documents are foreign

Check and complete the following paragraph only if the applicant is applying for an ITIN under

“Exception 1(a) - Partnership Interest”.

The undersigned further certifies that the Applicant has provided a copy of the relevant pages of the Partnership

Agreement of

and

(Name of Partnership)

EIN

as documentation in support of meeting the requirements for Exception 1(a).

The undersigned further certifies that the documentation was reviewed in accordance with the procedures set forth in the

Acceptance Agent Agreement and is authentic, complete, and accurate based on the information and documentation

submitted by the applicant.

The Certifying Acceptance Agent shall retain copies of all relevant documents including signed copies of the Forms W-7

submitted to the IRS on behalf of the applicant upon which the Certifying Acceptance Agent has relied upon to certify the

applicant’s foreign status and identity.

(Signature Date)

(Signature of Authorized Representative)

Acceptance Agent EIN and Office Code

14194

Form

(Rev. 11-2011)

Catalog Number 56020G

Department of the Treasury – Internal Revenue Service

1

1 2

2