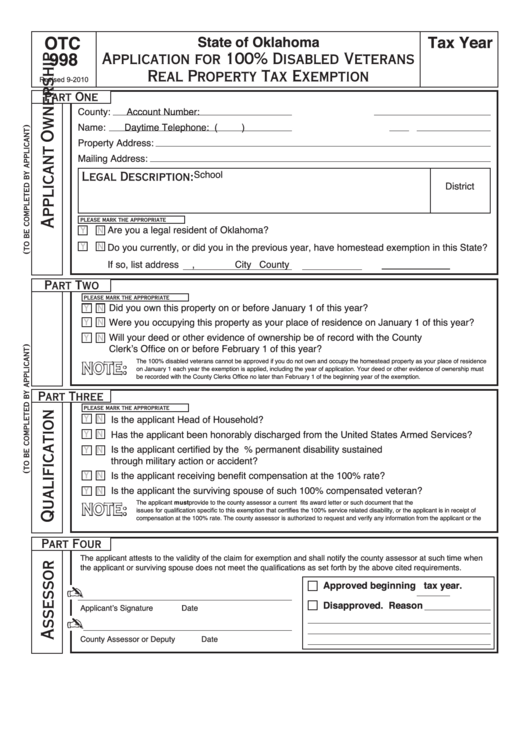

OTC

Tax Year

State of Oklahoma

998

Application for 100% Disabled Veterans

Real Property Tax Exemption

Revised 9-2010

Part One

County:

Account Number:

Name:

Daytime Telephone: (

)

Property Address:

Mailing Address:

School

Legal Description:

District

please mark the appropriate box...

Are you a legal resident of Oklahoma?

Y

N

Y

N

Do you currently, or did you in the previous year, have homestead exemption in this State?

If so, list address

,

City

County

Part Two

please mark the appropriate box...

Did you own this property on or before January 1 of this year?

Y

N

Were you occupying this property as your place of residence on January 1 of this year?

Y

N

Will your deed or other evidence of ownership be of record with the County

Y

N

Clerk’s Office on or before February 1 of this year?

The 100% disabled veterans cannot be approved if you do not own and occupy the homestead property as your place of residence

NOTE:

on January 1 each year the exemption is applied, including the year of application. Your deed or other evidence of ownership must

be recorded with the County Clerks Office no later than February 1 of the beginning year of the exemption.

Part Three

please mark the appropriate box...

Y N

Is the applicant Head of Household?

Has the applicant been honorably discharged from the United States Armed Services?

Y N

Is the applicant certified by the U.S.D.V.A. to have 100% permanent disability sustained

Y N

through military action or accident?

Is the applicant receiving benefit compensation at the 100% rate?

Y N

Is the applicant the surviving spouse of such 100% compensated veteran?

Y N

The applicant must provide to the county assessor a current U.S.D.V.A. benefits award letter or such document that the U.S.D.V.A.

NOTE:

issues for qualification specific to this exemption that certifies the 100% service related disability, or the applicant is in receipt of

compensation at the 100% rate. The county assessor is authorized to request and verify any information from the applicant or the

U.S.D.V.A. they may feel is relevant.

Part Four

The applicant attests to the validity of the claim for exemption and shall notify the county assessor at such time when

the applicant or surviving spouse does not meet the qualifications as set forth by the above cited requirements.

Approved beginning

tax year.

✍

Disapproved. Reason

Applicant’s Signature

Date

✍

County Assessor or Deputy

Date

1

1 2

2