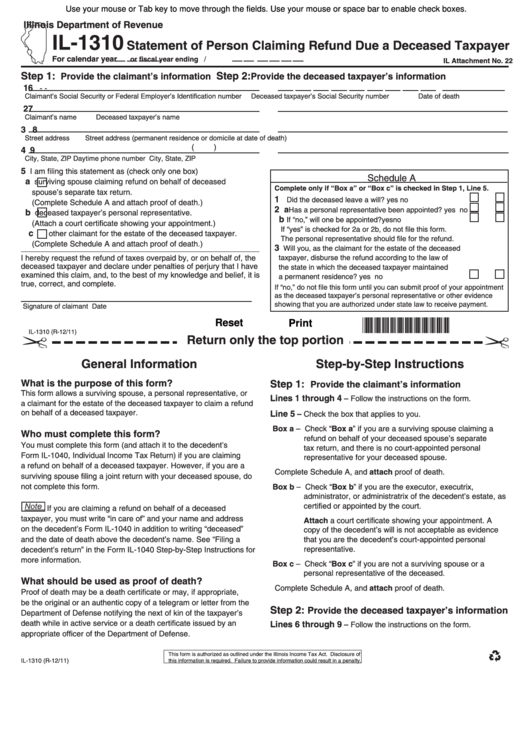

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-1310

Statement of Person Claiming Refund Due a Deceased Taxpayer

For calendar year

or fiscal year ending

/

IL Attachment No. 22

Step 1:

Step 2:

Provide the claimant’s information

Provide the deceased taxpayer’s information

1

6

-

-

Claimant’s Social Security or Federal Employer’s Identification number

Deceased taxpayer’s Social Security number Date of death

2

7

Claimant’s name

Deceased taxpayer’s name

3

8

Street address

Street address (permanent residence or domicile at date of death)

( )

4

9

City, State, ZIP

Daytime phone number

City, State, ZIP

5

I am filing this statement as (check only one box)

Schedule A

a

surviving spouse claiming refund on behalf of deceased

Complete only if “Box a” or “Box c” is checked in Step 1, Line 5.

spouse’s separate tax return.

1

Did the deceased leave a will?

yes

no

(Complete Schedule A and attach proof of death.)

2 a

Has a personal representative been appointed? yes

no

b

deceased taxpayer’s personal representative.

b

If “no,” will one be appointed?

yes

no

(Attach a court certificate showing your appointment.)

If “yes” is checked for 2a or 2b, do not file this form.

c

other claimant for the estate of the deceased taxpayer.

The personal representative should file for the refund.

(Complete Schedule A and attach proof of death.)

3

Will you, as the claimant for the estate of the deceased

I hereby request the refund of taxes overpaid by, or on behalf of, the

taxpayer, disburse the refund according to the law of

deceased taxpayer and declare under penalties of perjury that I have

the state in which the deceased taxpayer maintained

examined this claim, and, to the best of my knowledge and belief, it is

a permanent residence?

yes

no

true, correct, and complete.

If “no,” do not file this form until you can submit proof of your appointment

as the deceased taxpayer’s personal representative or other evidence

showing that you are authorized under state law to receive payment.

S ignature of claimant

Date

*159701110*

Reset

Print

IL-1310 (R-12/11)

Return only the top portion

General Information

Step-by-Step Instructions

What is the purpose of this form?

Step 1:

Provide the claimant’s information

This form allows a surviving spouse, a personal representative, or

Lines 1 through 4

– Follow the instructions on the form.

a claimant for the estate of the deceased taxpayer to claim a refund

on behalf of a deceased taxpayer.

Line 5

– Check the box that applies to you.

Box a – Check “Box a” if you are a surviving spouse claiming a

Who must complete this form?

refund on behalf of your deceased spouse’s separate

You must complete this form (and attach it to the decedent’s

tax return, and there is no court-appointed personal

Form IL-1040, Individual Income Tax Return) if you are claiming

representative for your deceased spouse.

a refund on behalf of a deceased taxpayer. However, if you are a

Complete Schedule A, and attach proof of death.

surviving spouse filing a joint return with your deceased spouse, do

not complete this form.

Box b – Check “Box b” if you are the executor, executrix,

administrator, or administratrix of the decedent’s estate, as

certified or appointed by the court.

If you are claiming a refund on behalf of a deceased

taxpayer, you must write “in care of” and your name and address

Attach a court certificate showing your appointment. A

on the decedent’s Form IL-1040 in addition to writing “deceased”

copy of the decedent’s will is not acceptable as evidence

and the date of death above the decedent’s name. See “Filing a

that you are the decedent’s court-appointed personal

representative.

decedent’s return” in the Form IL-1040 Step-by-Step Instructions for

more information.

Box c – Check “Box c” if you are not a surviving spouse or a

personal representative of the deceased.

What should be used as proof of death?

Complete Schedule A, and attach proof of death.

Proof of death may be a death certificate or may, if appropriate,

be the original or an authentic copy of a telegram or letter from the

Step 2:

Pr ovide th e deceased taxpayer’s information

Department of Defense notifying the next of kin of the taxpayer’s

death while in active service or a death certificate issued by an

Lines 6 through 9

– Follow the instructions on the form.

appropriate officer of the Department of Defense.

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-1310 (R-12/11)

this information is required. Failure to provide information could result in a penalty.

1

1