Form Fp-31 - Personal Property Tax - 2008 Page 6

ADVERTISEMENT

in your possession under a “Lease-Purchase” Agreement or

Unregistered motor vehicles and trailers

a “Security-Purchase” Agreement which obligates you to

Report on Schedule A the totals for all unregistered (not regis-

tered in DC) motor vehicles and trailers. Include the totals along

become the owner, must be reported in Schedule A.

Schedule D-2: Leased property in DC

with the totals for other tangible personal property on page 2 of

Complete this schedule only if you are a non QHTC and,

form FP-31, line 3, of columns A and B.

as lessor, rented or leased to any business or individual,

tangible personal property under a “Lease-Purchase” Agree-

Other tangible personal property

ment or a “Security-Purchase” Agreement under which the

Report on Schedule A the following tangible personal property:

trailers; construction equipment; special equipment mounted on

lessee is required to become the owner. Any other tangible

a vehicle or trailer (not used primarily for the transportation of

personal property owned by you and subject to a rental or

lease agreement or any other similar arrangement is reported

persons or property); boats; barges; dredges; aircraft; and other

in Schedule A.

tangible personal property. Enter the total original cost on page

2 of form FP-31, line 3, of column A and the total remaining

cost (current value) on page 2, line 3, of column B. Owners (les-

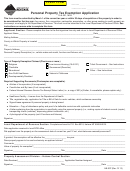

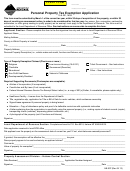

Complete and file the following schedules, as applicable,

sors) of leased property located in DC in addition to completing

if you are a QHTC amending your originally filed FP-31

Schedule A must complete Schedule D-2, if the property is not

return.

included in Schedule A.

Schedule D-3: Purchased property and QHTCs

This schedule is used to report qualifying tangible personal

Schedule B: Supplies

Report the cost of any consumable items not held for sale, such

property purchased after December 31, 2000 by a certified

as office and other supplies.

QHTC and used or held for use by the QHTC (or leased under

• Office supplies include, but are not limited to, items such as

a capital lease) to a certified QHTC. (This schedule is in Pub-

lication FR-399, Qualified High Technology Companies.)

stationery and envelopes used in the business or profession.

• Other supplies include, but are not limited to, wrapping and

Schedule D-4: Leased property and QHTCs

packing materials, advertising items, sales books, fuel oil,

china, glass and silverware. Enter the totals on page 2 of form

This schedule is used to report qualifying tangible personal

FP-31, line 4, of columns A and B.

property purchased after December 31, 2000, by a non

QHTC and leased to a certified QHTC under a capital lease.

This schedule is to be completed by the lessor of the prop-

Schedule C: Dispositions of tangible personal property

erty. (This schedule is in Publication FR-399, Qualified High

Report all fixed assets that were traded in, sold, donated,

Technology Companies.)

discarded or transferred out of a District of Columbia location

during the preceding tax year. This includes items reported on

last year’s return that are not reported in either Schedules A or

Amended Returns

Use Form FP-31 to file an amended personal property tax

D-2 of the current year’s return.

return. Please fill in the amended return oval located below

the address area. For prior year forms check our web site

Schedule D-1: Possession of leased property

You must file a separate

Complete this schedule only if you are a non QHTC and had

in your possession tangible personal property under either a

amended return for each year you are amending.

rental or lease agreement or under some other arrangement

Other Personal Property Tax Forms

with another business or individual and the tangible personal

• Railroad Tangible Personal Property Return, Form FP-32;

property is not owned by you. Any tangible personal property

• Railroad Company Report, Form FP-33; and

• Rolling Stock Tax Return, Form FP-34.

-6-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24