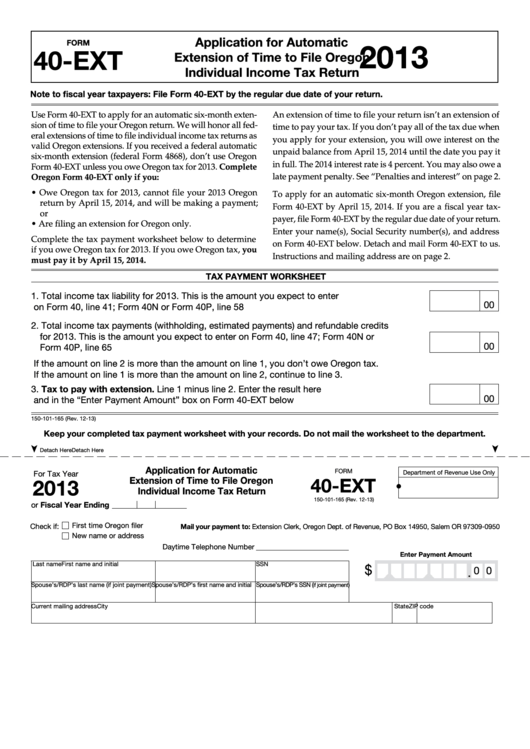

Application for Automatic

FORM

2013

40-EXT

Extension of Time to File Oregon

Individual Income Tax Return

Note to fiscal year taxpayers: File Form 40-EXT by the regular due date of your return.

Use Form 40-EXT to apply for an automatic six-month exten-

An extension of time to file your return isn’t an extension of

sion of time to file your Oregon return. We will honor all fed-

time to pay your tax. If you don’t pay all of the tax due when

eral extensions of time to file individual income tax returns as

you apply for your extension, you will owe interest on the

valid Oregon extensions. If you received a federal automatic

unpaid balance from April 15, 2014 until the date you pay it

six-month extension (federal Form 4868), don’t use Oregon

in full. The 2014 interest rate is 4 percent. You may also owe a

Form 40-EXT unless you owe Oregon tax for 2013. Complete

late payment penalty. See “Penalties and interest” on page 2.

Oregon Form 40-EXT only if you:

• Owe Oregon tax for 2013, cannot file your 2013 Oregon

To apply for an automatic six-month Oregon extension, file

return by April 15, 2014, and will be making a payment;

Form 40-EXT by April 15, 2014. If you are a fiscal year tax-

or

payer, file Form 40-EXT by the regular due date of your return.

• Are filing an extension for Oregon only.

Enter your name(s), Social Security number(s), and address

Complete the tax payment worksheet below to determine

on Form 40-EXT below. Detach and mail Form 40-EXT to us.

if you owe Oregon tax for 2013. If you owe Oregon tax, you

Instructions and mailing address are on page 2.

must pay it by April 15, 2014.

TAX PAYMENT WORKSHEET

1. Total income tax liability for 2013. This is the amount you expect to enter

00

on Form 40, line 41; Form 40N or Form 40P, line 58 .................................................................... 1

2. Total income tax payments (withholding, estimated payments) and refundable credits

for 2013. This is the amount you expect to enter on Form 40, line 47; Form 40N or

00

Form 40P, line 65 .......................................................................................................................... 2

If the amount on line 2 is more than the amount on line 1, you don’t owe Oregon tax.

If the amount on line 1 is more than the amount on line 2, continue to line 3.

3. Tax to pay with extension. Line 1 minus line 2. Enter the result here

00

and in the “Enter Payment Amount” box on Form 40-EXT below ................................................ 3

150-101-165 (Rev. 12-13)

Keep your completed tax payment worksheet with your records. Do not mail the worksheet to the department.

Detach Here

Detach Here

Application for Automatic

FORM

Department of Revenue Use Only

For Tax Year

40-EXT

Extension of Time to File Oregon

2013

•

Individual Income Tax Return

150-101-165 (Rev. 12-13)

or Fiscal Year Ending

First time Oregon filer

Check if:

Mail your payment to: Extension Clerk, Oregon Dept. of Revenue, PO Box 14950, Salem OR 97309-0950

New name or address

Daytime Telephone Number

Enter Payment Amount

Last name

First name and initial

SSN

$

0 0

.

Spouse’s/RDP’s last name (if joint payment)

Spouse’s/RDP’s first name and initial

Spouse’s/RDP’s SSN (

if joint payment)

Current mailing address

City

State

ZIP code

1

1 2

2