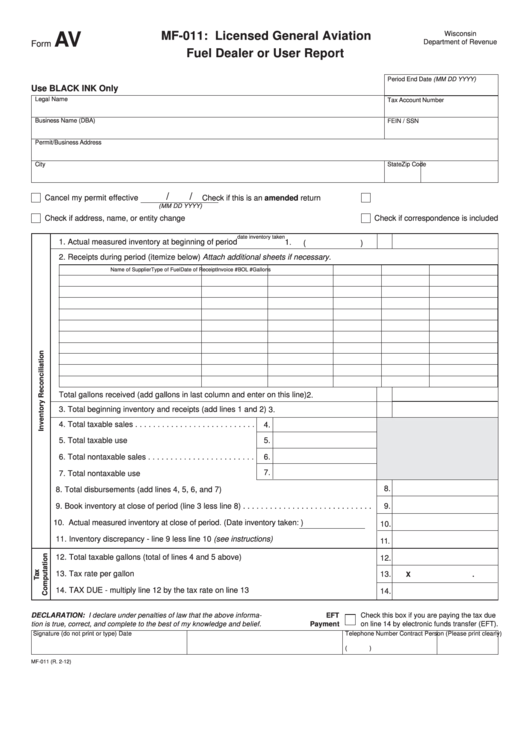

MF-011: Licensed General Aviation

Wisconsin

AV

Department of Revenue

Form

Fuel Dealer or User Report

Period End Date (MM DD YYYY)

Use BLACK INK Only

Legal Name

Tax Account Number

Business Name (DBA)

FEIN / SSN

Permit/Business Address

City

State

Zip Code

/

/

Cancel my permit effective

Check if this is an amended return

(MM DD YYYY)

Check if address, name, or entity change

Check if correspondence is included

date inventory taken

1. Actual measured inventory at beginning of period

1.

(

)

2. Receipts during period (itemize below)

Attach additional sheets if necessary.

Name of Supplier

Type of Fuel

Date of Receipt

Invoice #

BOL #

Gallons

Total gallons received (add gallons in last column and enter on this line)

2.

3. Total beginning inventory and receipts (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Total taxable sales . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Total taxable use . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Total nontaxable sales . . . . . . . . . . . . . . . . . . . . . . . .

6.

7.

7. Total nontaxable use . . . . . . . . . . . . . . . . . . . . . . . . .

8.

8. Total disbursements (add lines 4, 5, 6, and 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Book inventory at close of period (line 3 less line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Actual measured inventory at close of period. (Date inventory taken:

)

10.

11. Inventory discrepancy - line 9 less line 10 (see instructions). . . . . . . . . . . . . . . . . . . . . . .

11.

12. Total taxable gallons (total of lines 4 and 5 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Tax rate per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

X

.06

14. TAX DUE - multiply line 12 by the tax rate on line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

DECLARATION: I declare under penalties of law that the above informa-

EFT

Check this box if you are paying the tax due

Payment

on line 14 by electronic funds transfer (EFT).

tion is true, correct, and complete to the best of my knowledge and belief.

Signature (do not print or type)

Contract Person (Please print clearly)

Telephone Number

Date

(

)

MF-011 (R. 2-12)

1

1 2

2