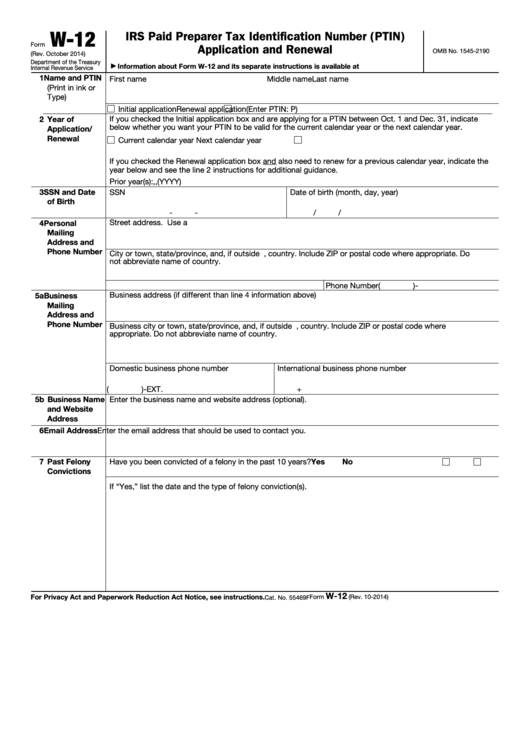

W-12

IRS Paid Preparer Tax Identification Number (PTIN)

Form

Application and Renewal

OMB No. 1545-2190

(Rev. October 2014)

Department of the Treasury

Information about Form W-12 and its separate instructions is available at

▶

Internal Revenue Service

1 Name and PTIN

First name

Middle name

Last name

(Print in ink or

Type)

Initial application

Renewal application

(Enter PTIN: P

)

If you checked the Initial application box and are applying for a PTIN between Oct. 1 and Dec. 31, indicate

2 Year of

below whether you want your PTIN to be valid for the current calendar year or the next calendar year.

Application/

Renewal

Current calendar year

Next calendar year

If you checked the Renewal application box and also need to renew for a previous calendar year, indicate the

year below and see the line 2 instructions for additional guidance.

Prior year(s):

,

,

(YYYY)

3 SSN and Date

SSN

Date of birth (month, day, year)

of Birth

-

-

/

/

Street address. Use a P.O. box number only if the post office does not deliver mail to your street address.

4 Personal

Mailing

Address and

Phone Number

City or town, state/province, and, if outside U.S., country. Include ZIP or postal code where appropriate. Do

not abbreviate name of country.

Phone Number (

)

-

Business address (if different than line 4 information above)

5a Business

Mailing

Address and

Phone Number

Business city or town, state/province, and, if outside U.S., country. Include ZIP or postal code where

appropriate. Do not abbreviate name of country.

Domestic business phone number

International business phone number

(

)

-

EXT.

+

5b Business Name

Enter the business name and website address (optional).

and Website

Address

6 Email Address Enter the email address that should be used to contact you.

7 Past Felony

Yes

No

Have you been convicted of a felony in the past 10 years?

Convictions

If “Yes,” list the date and the type of felony conviction(s).

W-12

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 10-2014)

Cat. No. 55469F

1

1 2

2 3

3