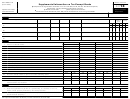

SCHEDULE K

OMB No. 1545-0047

Supplemental Information on Tax-Exempt Bonds

(Form 990)

2015

Complete if the organization answered “Yes” on Form 990, Part IV, line 24a. Provide descriptions,

▶

explanations, and any additional information in Part VI.

Open to Public

Attach to Form 990.

▶

Department of the Treasury

Inspection

Information about Schedule K (Form 990) and its instructions is at

Internal Revenue Service

▶

Employer identification number

Name of the organization

Part I

Bond Issues

(h) On

(i) Pooled

(a) Issuer name

(b) Issuer EIN

(c) CUSIP #

(d) Date issued

(e) Issue price

(f) Description of purpose

(g) Defeased

behalf of

financing

issuer

Yes No Yes No Yes No

A

B

C

D

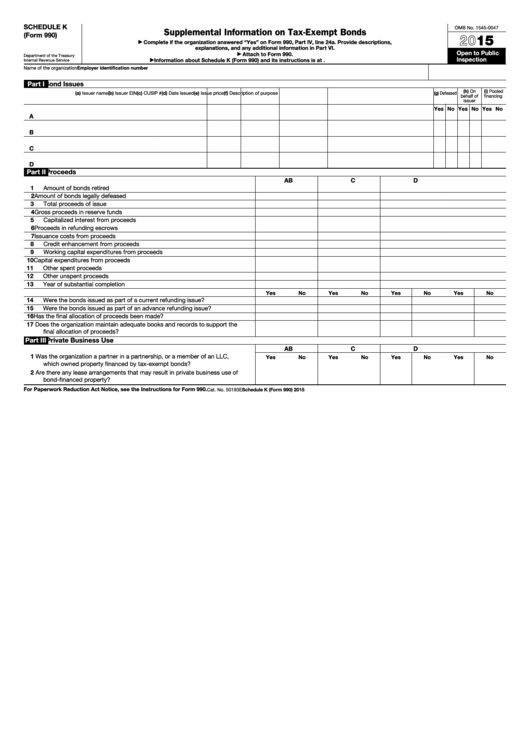

Part II

Proceeds

A

B

C

D

1

Amount of bonds retired .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

Amount of bonds legally defeased

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Total proceeds of issue .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Gross proceeds in reserve funds .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Capitalized interest from proceeds

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Proceeds in refunding escrows .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Issuance costs from proceeds .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Credit enhancement from proceeds .

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Working capital expenditures from proceeds .

.

.

.

.

.

.

.

.

.

.

10

Capital expenditures from proceeds .

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Other spent proceeds .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Other unspent proceeds .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Year of substantial completion .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

Yes

No

Yes

No

Yes

No

14

Were the bonds issued as part of a current refunding issue? .

.

.

.

.

.

15

Were the bonds issued as part of an advance refunding issue? .

.

.

.

.

16

Has the final allocation of proceeds been made? .

.

.

.

.

.

.

.

.

.

17

Does the organization maintain adequate books and records to support the

final allocation of proceeds?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part III

Private Business Use

A

B

C

D

1

Was the organization a partner in a partnership, or a member of an LLC,

Yes

No

Yes

No

Yes

No

Yes

No

which owned property financed by tax-exempt bonds? .

.

.

.

.

.

.

.

2

Are there any lease arrangements that may result in private business use of

bond-financed property? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

For Paperwork Reduction Act Notice, see the Instructions for Form 990.

Cat. No. 50193E

Schedule K (Form 990) 2015

1

1 2

2 3

3 4

4