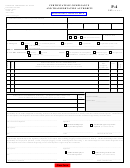

Return to Form

MF-209 INSTRUCTIONS

GENERAL INFORMATION

DATE COVERED BY CERTIFICATE

Wisconsin law allows a tax credit or refund to persons

• Effective Date - enter date exemption first applies.

Must be on or after date signed by both the customer

who sell tax-paid gasoline and/or undyed diesel

fuel for exempt use. Fuel suppliers who are licensed

and supplier.

with the department may claim a deduction for exempt

sales on their monthly motor vehicle fuel tax reports.

• Expiration Date - Enter the expiration date. This

Nonlicensed suppliers must file a refund claim (MF-

certificate is valid for a maximum of 1-year from the

012) with the department to receive a refund of the

effective date unless cancelled by the customer or

motor vehicle fuel tax they pay when purchasing the

the Wisconsin Department of Revenue.

fuel for resale.

ASSISTANCE

For a licensed supplier or a nonlicensed supplier to

You can access the department’s web site, at www.

make exempt sales to customers, suppliers must

revenue.wi.gov. From this web site, you can:

obtain an exemption certificate from customers at-

testing to the exempt use of the fuel purchased. If

• Complete electronic fill-in forms

a customer makes exempt purchases from more

• Download forms, schedules, instructions, and

than one supplier, the customer must execute an

publications

exemption certificate with each supplier. Suppliers

• View answers to commonly asked questions

and customers must retain copies of executed ex-

• E-mail us for assistance

emption certificates in their records. DO NOT SEND

• Access My Tax Account

copies of exemption certificates to the department

unless requested.

Madison Office Location

2135 Rimrock Road

Gasoline may be sold tax-exempt for off-road use

Madison WI 53713

(for example: farming, construction, logging). How-

ever, undyed diesel fuel must be sold tax-included.

Mailing Address

Purchasers of this fuel may file a claim for refund

Excise Tax Section 6-107

of the fuel tax relating to their off-road use with the

Wisconsin Department of Revenue

department.

PO Box 8900

Madison WI 53708-8900

Claims should be filed electronically using Form MF-

001 located at:

Phone: (608) 266-3223 or (608) 266-0064

Fax: (608) 264-7049

motorfuel.html. Forms are also available at www.

E-mail: excise@revenue.wi.gov

revenue.wi.gov/forms/excise/index-f.html.

Return to Form

1

1 2

2