File pg. 1

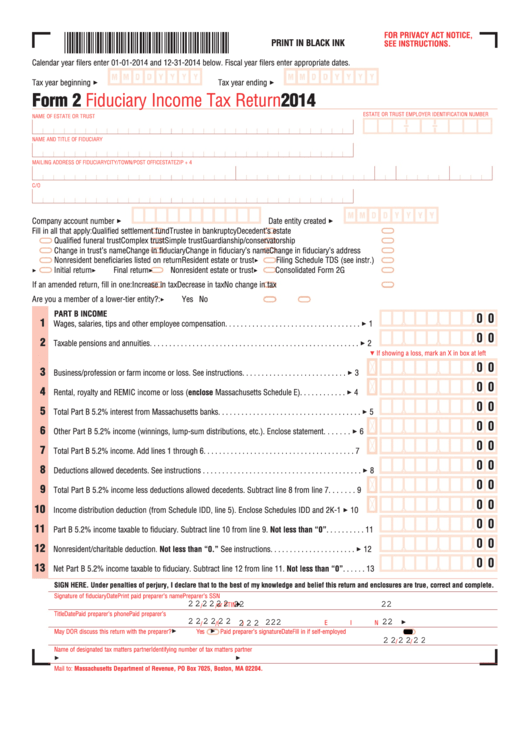

FOR PRIVACY ACT NOTICE,

PRINT IN BLACK INK

SEE INSTRUCTIONS.

Calendar year filers enter 01-01-2014 and 12-31-2014 below. Fiscal year filers enter appropriate dates.

Tax year beginning 3

Tax year ending 3

Form 2

Fiduciary Income Tax Return

2014

ESTATE OR TRUST EMPLOYER IDENTIFICATION NUMBER

NAME OF ESTATE OR TRUST

NAME AND TITLE OF FIDUCIARY

MAILING ADDRESS OF FIDUCIARY

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

C/O

Company account number 3

Date entity created 3

Fill in all that apply:

Qualified settlement fund

Trustee in bankruptcy

Decedent’s estate

Qualified funeral trust

Complex trust

Simple trust

Guardianship/conservatorship

Change in trust’s name

Change in fiduciary

Change in fiduciary’s name

Change in fiduciary’s address

Nonresident beneficiaries listed on return

Resident estate or trust

Filing Schedule TDS (see instr.)

3

Initial return

Final return

Nonresident estate or trust

Consolidated Form 2G

3

3

3

3

If an amended return, fill in one:

Increase in tax

Decrease in tax

No change in tax

Are you a member of a lower-tier entity?:

Yes

N o

3

PART B INCOME

0 0

1

Wages, salaries, tips and other employee compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

0 0

2

Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

If showing a loss, mark an X in box at left

5

0 0

3

Business/profession or farm income or loss. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

0 0

4

Rental, royalty and REMIC income or loss (enclose Massachusetts Schedule E) . . . . . . . . . . . . 3 4

0 0

5

Total Part B 5.2% interest from Massachusetts banks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

0 0

6

Other Part B 5.2% income (winnings, lump-sum distributions, etc.). Enclose statement. . . . . . . 3 6

0 0

7

Total Part B 5.2% income. Add lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

0 0

8

Deductions allowed decedents. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

0 0

9

Total Part B 5.2% income less deductions allowed decedents. Subtract line 8 from line 7 . . . . . . . 9

0 0

10

Income distribution deduction (from Schedule IDD, line 5). Enclose Schedules IDD and 2K-1 3 10

0 0

11

Part B 5.2% income taxable to fiduciary. Subtract line 10 from line 9. Not less than “0” . . . . . . . . . . 11

0 0

12

Nonresident/charitable deduction. Not less than “0.” See instructions . . . . . . . . . . . . . . . . . . . . . . 3 12

0 0

13

Net Part B 5.2% income taxable to fiduciary. Subtract line 12 from line 11. Not less than “0”. . . . . . 13

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of fiduciary

Date

Print paid preparer’s name

Preparer’s SSN

2 2 2 2 2 2 22

or PTIN

22

3

/

/

Title

Date

Paid preparer’s phone

Paid preparer’s

2 2 2 2 2 2 2 2 2 222

(

)

EIN

22

/

/

3

May DOR discuss this return with the preparer?

Yes

Paid preparer’s signature

Date

Fill in if self-employed

3

3

2 2 2 2 2 2

/

/

Name of designated tax matters partner

Identifying number of tax matters partner

3

3

Mail to: Massachusetts Department of Revenue, PO Box 7025, Boston, MA 02204.

1

1 2

2 3

3