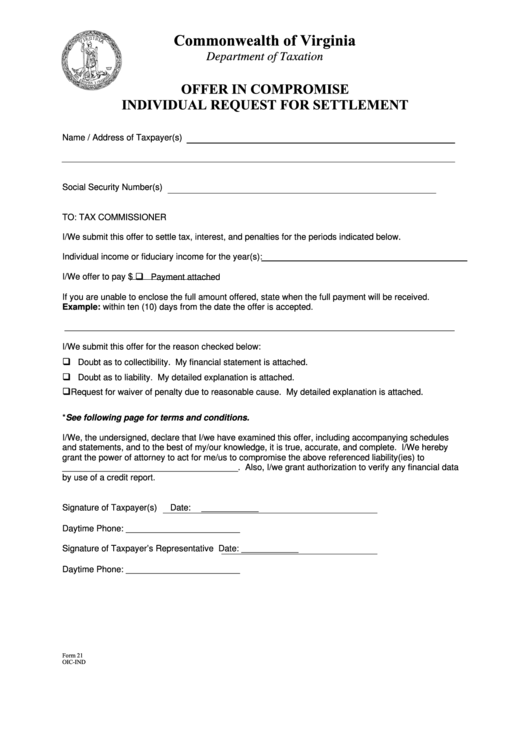

Commonwealth of Virginia

Department of Taxation

OFFER IN COMPROMISE

INDIVIDUAL REQUEST FOR SETTLEMENT

Name / Address of Taxpayer(s)

Social Security Number(s)

TO: TAX COMMISSIONER

I/We submit this offer to settle tax, interest, and penalties for the periods indicated below.

Individual income or fiduciary income for the year(s):

I/We offer to pay $

Payment attached

If you are unable to enclose the full amount offered, state when the full payment will be received.

Example: within ten (10) days from the date the offer is accepted.

__________________________________________________________________________________

I/We submit this offer for the reason checked below:

Doubt as to collectibility. My financial statement is attached.

Doubt as to liability. My detailed explanation is attached.

Request for waiver of penalty due to reasonable cause. My detailed explanation is attached.

*See following page for terms and conditions.

I/We, the undersigned, declare that I/we have examined this offer, including accompanying schedules

and statements, and to the best of my/our knowledge, it is true, accurate, and complete. I/We hereby

grant the power of attorney to act for me/us to compromise the above referenced liability(ies) to

_____________________________________. Also, I/we grant authorization to verify any financial data

by use of a credit report.

Signature of Taxpayer(s)

Date: ____________

Daytime Phone: ________________________

Signature of Taxpayer’s Representative

Date: ____________

Daytime Phone: ________________________

Form 21

OIC-IND

1

1 2

2 3

3 4

4