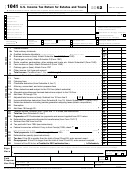

M2XP2

Adjustments to Income

A—As previously reported

B—Net change

C—Corrected amount

32 State and municipal bond interest from outside Minnesota . . . . 32

33 State income tax deducted on federal return . . . . . . . . . . . . . . . . 33

34 Expenses deducted on your federal return that are attributable

to income not taxed by Minnesota(other than U .S . bond interest) . . 34

35 80 percent of suspended loss from 2001-2005 or 2008-2011

on federal return generated by bonus depreciation . . . . . . . . . . . 35

36 80 percent of federal bonus depreciation . . . . . . . . . . . . . . . . . . . 36

37 Fines, fees and penalties deducted federally as

trade or business expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

38 Net operating loss carryover adjustment . . . . . . . . . . . . . . . . . . . . 38

39 Domestic production activities deduction . . . . . . . . . . . . . . . . . . . 39

40 Federal tax-exempt subsidies paid to employers for providing

prescription drug coverage for their retirees . . . . . . . . . . . . . . . . . 40

41 Add lines 32 through 40. Also enter the amount from

line 41C on line 51, column E, under Additions . . . . . . . . . . . . . . . 41

42 Interest on U.S. government bond obligations, minus expenses

deducted on federal return that are attributable to this income . . . 42

43 State income tax refund included on federal return . . . . . . . . . . . 43

44 Federal bonus depreciation subtraction . . . . . . . . . . . . . . . . . . . . 44

45 Job Opportunity Building Zone (JOBZ) business

and investment income exemptions . . . . . . . . . . . . . . . . . . . . . . . . 45

46 Subtraction for prior addback of reacquisition of business

indebtedness income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

47 Net operating loss carryover adjustment . . . . . . . . . . . . . . . . . . . . 47

48 Add lines 42 through 47. Also enter the amount from

line 48C on line 51, column E, under Subtractions . . . . . . . . . . . . 48

Allocation of adjustments between fiduciary and beneficiaries

A

B

C

D

E

Percent of

Shares assignable to beneficiary and to fiduciary

Beneficiary’s Social

Share of federal

total on line

Name of each beneficiary

Security number

distributable net income

51, column C

Additions

Subtractions

49

%

%

%

%

50 Fiduciary

%

51 Total

100%

Enclose separate sheet, if needed .

EXPLANATION OF CHANGE—Explain each change in detail in the space provided below. Use a separate sheet, if needed. If

the changes involve items requiring supporting information, be sure to attach the appropriate schedule, statement or form to

Form M2X to verify the correct amount.

1

1 2

2 3

3 4

4