Form Nc K-1 - Shareholder'S Share Of North Carolina Income, Adjustments, And Credits

ADVERTISEMENT

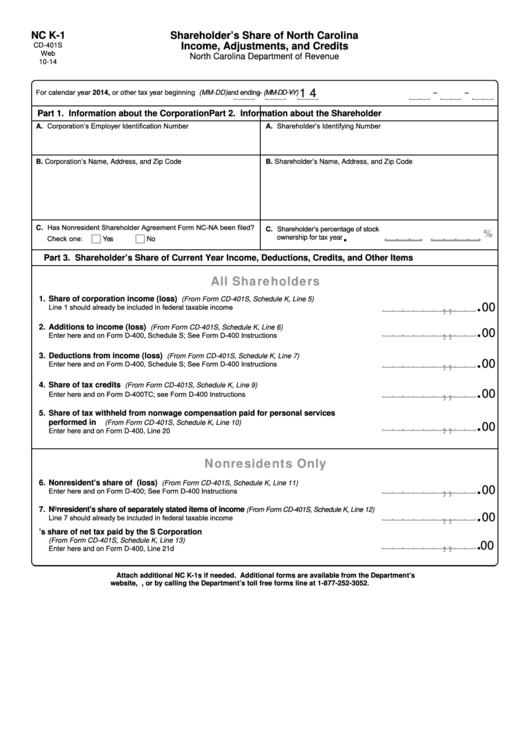

NC K-1

Shareholder’s Share of North Carolina

Income, Adjustments, and Credits

CD-401S

Web

North Carolina Department of Revenue

10-14

For calendar year 2014, or other tax year beginning (MM-DD)

and ending (MM-DD-YY)

1 4

Part 1. Information about the Corporation

Part 2. Information about the Shareholder

A. Corporation’s Employer Identification Number

A. Shareholder’s Identifying Number

B. Corporation’s Name, Address, and Zip Code

B. Shareholder’s Name, Address, and Zip Code

C. Has Nonresident Shareholder Agreement Form NC-NA been filed?

C. Shareholder’s percentage of stock

.

%

Check one:

ownership for tax year

Yes

No

Part 3. Shareholder’s Share of Current Year Income, Deductions, Credits, and Other Items

All Shareholders

1.

Share of corporation income (loss)

(From Form CD-401S, Schedule K, Line 5)

.

,

,

Line 1 should already be included in federal taxable income

00

,

,

.

2.

Additions to income (loss)

(From Form CD-401S, Schedule K, Line 6)

00

Enter here and on Form D-400, Schedule S; See Form D-400 Instructions

3.

Deductions from income (loss)

(From Form CD-401S, Schedule K, Line 7)

,

,

.

00

Enter here and on Form D-400, Schedule S; See Form D-400 Instructions

4.

Share of tax credits

(From Form CD-401S, Schedule K, Line 9)

,

,

.

00

Enter here and on Form D-400TC; see Form D-400 Instructions

5.

Share of tax withheld from nonwage compensation paid for personal services

,

,

.

performed in N.C.

(From Form CD-401S, Schedule K, Line 10)

00

Enter here and on Form D-400, Line 20

Nonresidents Only

,

,

.

6.

Nonresident’s share of N.C. taxable income (loss)

(From Form CD-401S, Schedule K, Line 11)

00

Enter here and on Form D-400; See Form D-400 Instructions

7.

Nonresident’s share of separately stated items of income

,

,

.

(From Form CD-401S, Schedule K, Line 12)

00

Line 7 should already be included in federal taxable income

8. Nonresident’s share of net tax paid by the S Corporation

,

,

.

(From Form CD-401S, Schedule K, Line 13)

00

Enter here and on Form D-400, Line 21d

Attach additional NC K-1s if needed. Additional forms are available from the Department’s

website, , or by calling the Department’s toll free forms line at 1-877-252-3052.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1