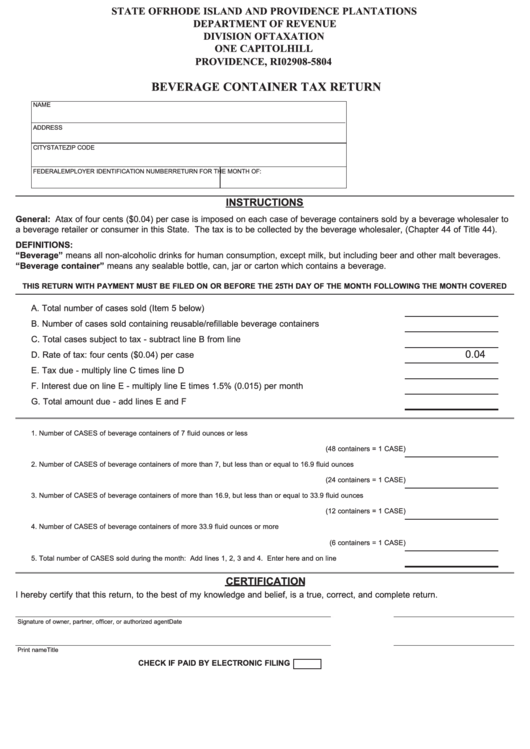

Form Bct-1 - Beverage Container Tax Return

ADVERTISEMENT

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DEPARTMENT OF REVENUE

DIVISION OF TAXATION

ONE CAPITOL HILL

PROVIDENCE, RI 02908-5804

BEVERAGE CONTAINER TAX RETURN

NAME

ADDRESS

CITY

STATE

ZIP CODE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

RETURN FOR THE MONTH OF:

INSTRUCTIONS

General: A tax of four cents ($0.04) per case is imposed on each case of beverage containers sold by a beverage wholesaler to

a beverage retailer or consumer in this State. The tax is to be collected by the beverage wholesaler, (Chapter 44 of Title 44).

DEFINITIONS:

“Beverage” means all non-alcoholic drinks for human consumption, except milk, but including beer and other malt beverages.

“Beverage container” means any sealable bottle, can, jar or carton which contains a beverage.

THIS RETURN WITH PAYMENT MUST BE FILED ON OR BEFORE THE 25TH DAY OF THE MONTH FOLLOWING THE MONTH COVERED

A. Total number of cases sold (Item 5 below) ..................................................................................

B. Number of cases sold containing reusable/refillable beverage containers ..................................

C. Total cases subject to tax - subtract line B from line A ................................................................

0.04

D. Rate of tax: four cents ($0.04) per case ......................................................................................

E. Tax due - multiply line C times line D ...........................................................................................

F. Interest due on line E - multiply line E times 1.5% (0.015) per month .........................................

G. Total amount due - add lines E and F ..........................................................................................

1. Number of CASES of beverage containers of 7 fluid ounces or less each.........................................................................

(48 containers = 1 CASE)

2. Number of CASES of beverage containers of more than 7, but less than or equal to 16.9 fluid ounces each...................

(24 containers = 1 CASE)

3. Number of CASES of beverage containers of more than 16.9, but less than or equal to 33.9 fluid ounces each..............

(12 containers = 1 CASE)

4. Number of CASES of beverage containers of more 33.9 fluid ounces or more each.........................................................

(6 containers = 1 CASE)

5. Total number of CASES sold during the month: Add lines 1, 2, 3 and 4. Enter here and on line A above.......................

CERTIFICATION

I hereby certify that this return, to the best of my knowledge and belief, is a true, correct, and complete return.

Signature of owner, partner, officer, or authorized agent

Date

Print name

Title

CHECK IF PAID BY ELECTRONIC FILING

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1