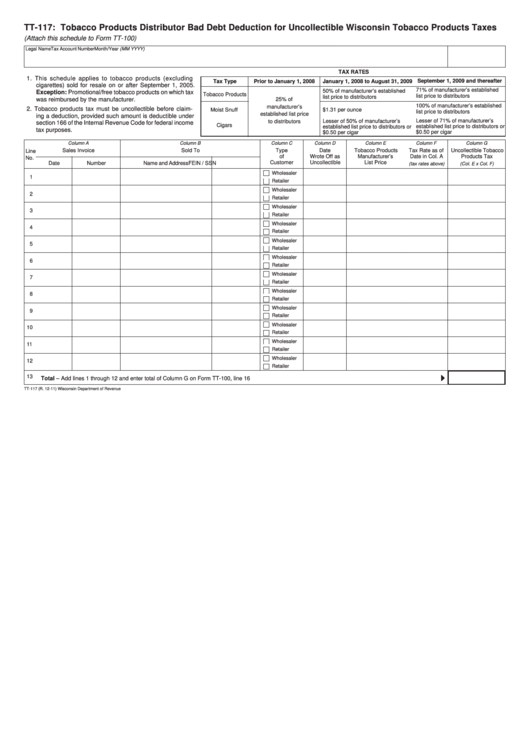

Form Tt-117 - Tobacco Products Distributor Bad Debt Deduction For Uncollectible Wisconsin Tobacco Products Taxes

ADVERTISEMENT

TT-117: Tobacco Products Distributor Bad Debt Deduction for Uncollectible Wisconsin Tobacco Products Taxes

(Attach this schedule to Form TT-100)

Legal Name

Tax Account Number

Month/Year (MM YYYY)

TAX RATES

1. This schedule applies to tobacco products (excluding

September 1, 2009 and thereafter

Tax Type

Prior to January 1, 2008

January 1, 2008 to August 31, 2009

cigarettes) sold for resale on or after September 1, 2005.

71% of manufacturer’s established

50% of manufacturer’s established

Exception: Promotional/free tobacco products on which tax

Tobacco Products

list price to distributors

list price to distributors

was reimbursed by the manufacturer.

25% of

100% of manufacturer’s established

manufacturer’s

2. Tobacco products tax must be uncollectible before claim-

$1.31 per ounce

Moist Snuff

list price to distributors

established list price

ing a deduction, provided such amount is deductible under

Lesser of 71% of manufacturer’s

to distributors

Lesser of 50% of manufacturer’s

section 166 of the Internal Revenue Code for federal income

Cigars

established list price to distributors or

established list price to distributors or

tax purposes.

$0.50 per cigar

$0.50 per cigar

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Sales Invoice

Sold To

Type

Date

Tobacco Products

Tax Rate as of

Uncollectible Tobacco

Line

of

Wrote Off as

Manufacturer’s

Date in Col. A

Products Tax

No.

Customer

Uncollectible

List Price

Date

Number

Name and Address

FEIN / SSN

(tax rates above)

(Col. E x Col. F)

Wholesaler

1

Retailer

Wholesaler

2

Retailer

Wholesaler

3

Retailer

Wholesaler

4

Retailer

Wholesaler

5

Retailer

Wholesaler

6

Retailer

Wholesaler

7

Retailer

Wholesaler

8

Retailer

Wholesaler

9

Retailer

Wholesaler

10

Retailer

Wholesaler

11

Retailer

Wholesaler

12

Retailer

13

Total – Add lines 1 through 12 and enter total of Column G on Form TT-100, line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TT-117 (R. 12-11)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2