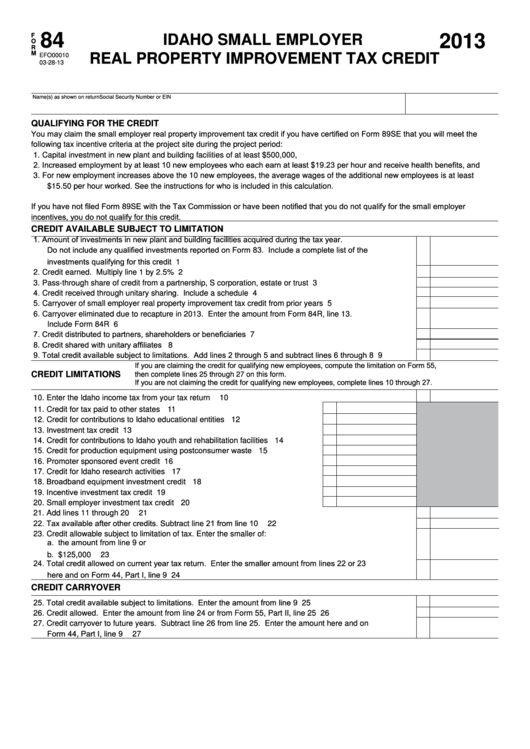

84

F

2013

IDAHO SMALL EMPLOYER

O

R

M

REAL PROPERTY IMPROVEMENT TAX CREDIT

EFO00010

03-28-13

Name(s) as shown on return

Social Security Number or EIN

QUALIFYING FOR THE CREDIT

You may claim the small employer real property improvement tax credit if you have certified on Form 89SE that you will meet the

following tax incentive criteria at the project site during the project period:

1. Capital investment in new plant and building facilities of at least $500,000,

2. Increased employment by at least 10 new employees who each earn at least $19.23 per hour and receive health benefits, and

3. For new employment increases above the 10 new employees, the average wages of the additional new employees is at least

$15.50 per hour worked. See the instructions for who is included in this calculation.

If you have not filed Form 89SE with the Tax Commission or have been notified that you do not qualify for the small employer

incentives, you do not qualify for this credit.

CREDIT AVAILABLE SUBJECT TO LIMITATION

1. Amount of investments in new plant and building facilities acquired during the tax year.

Do not include any qualified investments reported on Form 83. Include a complete list of the

investments qualifying for this credit ..............................................................................................................

1

2. Credit earned. Multiply line 1 by 2.5% ..........................................................................................................

2

3. Pass-through share of credit from a partnership, S corporation, estate or trust ............................................

3

4. Credit received through unitary sharing. Include a schedule ........................................................................

4

5. Carryover of small employer real property improvement tax credit from prior years .....................................

5

6. Carryover eliminated due to recapture in 2013. Enter the amount from Form 84R, line 13.

Include Form 84R ..........................................................................................................................................

6

7. Credit distributed to partners, shareholders or beneficiaries .........................................................................

7

8. Credit shared with unitary affiliates ...............................................................................................................

8

9. Total credit available subject to limitations. Add lines 2 through 5 and subtract lines 6 through 8 ................

9

If you are claiming the credit for qualifying new employees, compute the limitation on Form 55,

CREDIT LIMITATIONS

then complete lines 25 through 27 on this form.

If you are not claiming the credit for qualifying new employees, complete lines 10 through 27.

10. Enter the Idaho income tax from your tax return ............................................................................................

10

11. Credit for tax paid to other states ........................................................................

11

12. Credit for contributions to Idaho educational entities ..........................................

12

13. Investment tax credit ..........................................................................................

13

14. Credit for contributions to Idaho youth and rehabilitation facilities ......................

14

15. Credit for production equipment using postconsumer waste ..............................

15

16. Promoter sponsored event credit .......................................................................

16

17. Credit for Idaho research activities .....................................................................

17

18. Broadband equipment investment credit ............................................................

18

19. Incentive investment tax credit ...........................................................................

19

20. Small employer investment tax credit .................................................................

20

21. Add lines 11 through 20 .................................................................................................................................

21

22. Tax available after other credits. Subtract line 21 from line 10 ......................................................................

22

23. Credit allowable subject to limitation of tax. Enter the smaller of:

a. the amount from line 9 or

b. $125,000 ...................................................................................................................................................

23

24. Total credit allowed on current year tax return. Enter the smaller amount from lines 22 or 23

here and on Form 44, Part I, line 9 ................................................................................................................

24

CREDIT CARRYOVER

25. Total credit available subject to limitations. Enter the amount from line 9 ....................................................

25

26. Credit allowed. Enter the amount from line 24 or from Form 55, Part II, line 25 ..........................................

26

27. Credit carryover to future years. Subtract line 26 from line 25. Enter the amount here and on

Form 44, Part I, line 9 ....................................................................................................................................

27

1

1 2

2 3

3