R-6701 (1/14)

CIT-624

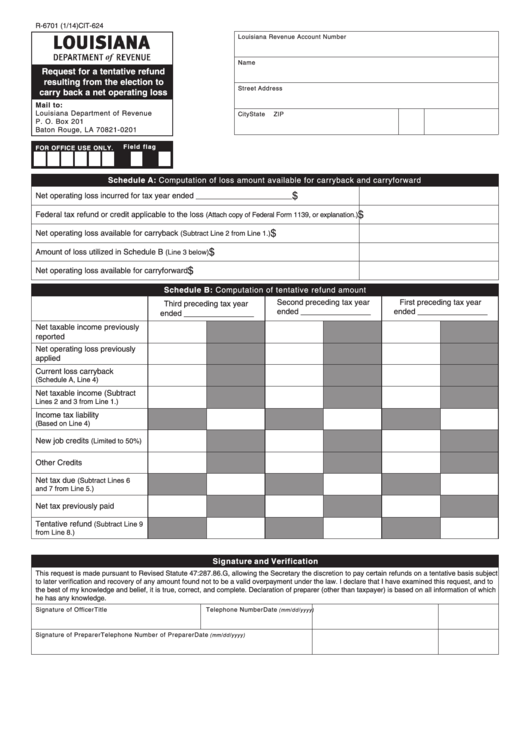

Louisiana Revenue Account Number

Name

Request for a tentative refund

resulting from the election to

Street Address

carry back a net operating loss

Mail to:

Louisiana Department of Revenue

City

State

ZIP

P. O. Box 201

Baton Rouge, LA 70821-0201

Fie ld f la g

FOR OFFICE USE ONLY.

Schedule A: Computation of loss amount available for carryback and carryforward

$

Net operating loss incurred for tax year ended ______________________

$

Federal tax refund or credit applicable to the loss

(Attach copy of Federal Form 1139, or explanation.)

$

Net operating loss available for carryback

(Subtract Line 2 from Line 1.)

$

Amount of loss utilized in Schedule B

(Line 3 below)

$

Net operating loss available for carryforward

Schedule B: Computation of tentative refund amount

Second preceding tax year

First preceding tax year

Third preceding tax year

ended ________________

ended ________________

ended ________________

Net taxable income previously

reported

Net operating loss previously

applied

Current loss carryback

(Schedule A, Line 4)

Net taxable income (Subtract

Lines 2 and 3 from Line 1.)

Income tax liability

(Based on Line 4)

New job credits

(Limited to 50%)

Other Credits

Net tax due

(Subtract Lines 6

and 7 from Line 5.)

Net tax previously paid

Tentative refund

(Subtract Line 9

from Line 8.)

Signature and Verification

This request is made pursuant to Revised Statute 47:287.86.G, allowing the Secretary the discretion to pay certain refunds on a tentative basis subject

to later verification and recovery of any amount found not to be a valid overpayment under the law. I declare that I have examined this request, and to

the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which

he has any knowledge.

Signature of Officer

Title

Telephone Number

Date

(mm/dd/yyyy)

Signature of Preparer

Telephone Number of Preparer

Date

(mm/dd/yyyy)

1

1 2

2