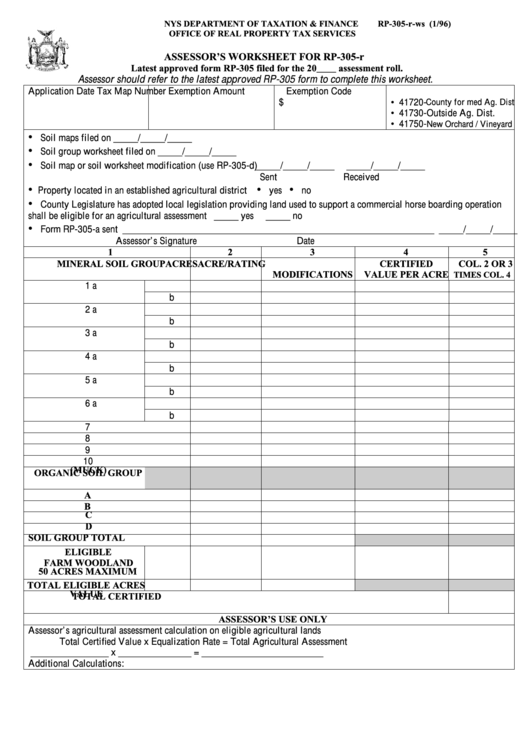

NYS DEPARTMENT OF TAXATION & FINANCE

RP-305-r-ws (1/96)

OFFICE OF REAL PROPERTY TAX SERVICES

ASSESSOR’S WORKSHEET FOR RP-305-r

Latest approved form RP-305 filed for the 20____ assessment roll.

Assessor should refer to the latest approved RP-305 form to complete this worksheet.

Application Date

Tax Map Number

Exemption Amount

Exemption Code

$

• 41720-

County for med Ag. Dist.

• 41730-Outside Ag. Dist.

• 41750-

New Orchard / Vineyard

•

Soil maps filed on _____/_____/_____

•

Soil group worksheet filed on _____/_____/_____

•

Soil map or soil worksheet modification (use RP-305-d)

_____/_____/_____

_____/_____/_____

Sent

Received

•

•

•

Property located in an established agricultural district

yes

no

•

County Legislature has adopted local legislation providing land used to support a commercial horse boarding operation

shall be eligible for an agricultural assessment _____ yes

_____ no

•

Form RP-305-a sent ________________________________________________________________ _____/_____/_____

Assessor’s Signature

Date

1

2

3

4

5

MINERAL SOIL GROUP

ACRES

ACRE/RATING

CERTIFIED

COL. 2 OR 3

MODIFICATIONS

VALUE PER ACRE

TIMES COL. 4

1

a

b

2

a

b

3

a

b

4

a

b

5

a

b

6

a

b

7

8

9

10

ORGANIC SOIL GROUP

(MUCK)

A

B

C

D

SOIL GROUP TOTAL

ELIGIBLE

FARM WOODLAND

50 ACRES MAXIMUM

TOTAL ELIGIBLE ACRES

TOTAL CERTIFIED

VALUE

ASSESSOR’S USE ONLY

Assessor’s agricultural assessment calculation on eligible agricultural lands

Total Certified Value

x

Equalization Rate

=

Total Agricultural Assessment

________________

x

_______________

=

_________________________

Additional Calculations:

1

1 2

2