Page 3

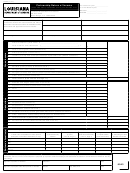

Schedule E — Gain or loss from sale of property other than capital assets (See instructions for Line 10.)

1. Description of property

2. Date

3. Date

4. Gross sales price

5. Depreciation al-

6. Cost or other basis

7. Expense of sale

8. Gain or loss

acquired

sold

lowed (or allowable)

and cost of improve-

(Column 4 plus

since acquisition or

ments subsequent

Column

Jan. 1, 1934 (Attach

to acquisition or Jan.

5, less the sum of

schedule.)

1, 1934

Columns 6 and 7)

Total (Transfer net gain or loss to Line 10, Page 1)

$

Schedule F — Bad debts (See instructions for Line 19.)

1. Current and 3

2. Net profit from business

3. Sales on account

4. Bad debts (See instruc-

If organization carried a reserve

prior years

tions for Line 19.)

5. Gross amount added

6. Amount charged against reserve

to reserve

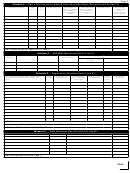

Schedule G — Depreciation (See instructions for Line 21.)

1. Kind of property (If buildings, state materials of which

2. Date

3. Cost or other basis

4. Depreciation al-

5. Method of comput-

6. Rate

7. Depreciation

constructed.) Exclude land and other nondepreciable

acquired

(Exclude land.)

lowed (or allowable)

ing depreciation

(%) or life

for this year

property.

in prior years

(years)

1. Total

$

2. Less: amount of depreciation claimed in Schedules A and B and elsewhere on return

3. Balance (Print here and on Line 21, Page 1.)

$

Schedule H — Other deductions (See instructions for Line 24.)

Explanation

Amount

Explanation

Amount

Total (Print here and on Line 24, Page 1.)

$

6045

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11