(2) Sum of the years-digit method — Under this method,

statement indicating (1) the amount of each class of exempt

annual allowances for depreciation are computed by

income, and (2) the amount of expense allocated to each

applying changing fractions to the taxpayer’s cost or

class of exempt income. Any amount of expense calculated

other basis of property (reduced by estimated salvage

by apportionment must be shown separately.

value). The deduction for each year is computed by

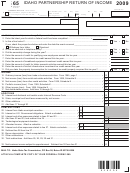

Line 25 Total Deductions — Add the amounts on Lines 13 through

multiplying the cost or other basis of the asset (reduced

24 and enter the result.

by estimated salvage value) by the number of years of

useful life remaining (including the year for which the

Line 26 Net Income (or Loss) — Subtract Line 25 from Line 12 and

deduction is computed) and dividing the product by the

enter the result.

sum of all the digits corresponding to the years of the

Line 27 Net Gain from Sale of Capital Assets — Enter on Line 27

estimated useful life of the assets.

the amount of gain from the sale or exchange of capital assets

(3) Other methods — A taxpayer may use any consistent

included on Line 9.

method that does not result in accumulated allowances at

the end of the year greater than the total of the accumulated

Line 28 Ordinary Income (or Loss) — Subtract Line 27 from Line 26

allowances that would have resulted from the use of the

and enter the result.

declining method. This limitation applies only during the

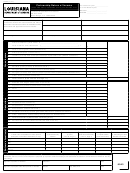

Partners’ Allocations — This schedule should show complete

first two-thirds of the useful life of the property.

information indicating all persons who were members of the

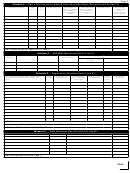

If a deduction is claimed for depreciation, Schedule G must be

partnership, syndicate, group, etc., during any portion of the taxable

completed. When obsolescence is included, state separately the

year. Although the partnership is not subject to income tax, the individual

amount claimed and the basis upon which it is computed. Land

members are liable for income tax and are subject to tax on their distribu-

values or costs must not be included in this schedule, and where

tive shares of the income of the partnership, whether distributed or not,

land and buildings were purchased for a lump sum, the cost of

and each is required to include his share in his return. However, a partner

the building subject to depreciation must be established. The

may not claim on his separate return a distributive share of loss from a

total amount of depreciation allowed on each property in prior

partnership to the extent any such loss exceeds the basis of his interest

years must be shown, and if the cost of any asset has been fully

in the partnership. The excess of such loss may be claimed for later years

recovered through previous depreciation allowances, the cost

to the extent that the basis for the partner’s interest is increased above

of such assets must not be included in the cost shown in the

zero. Each partner should be advised by the partnership of his share of

schedule of depreciable assets. See R.S. 47:65 and R.S. 47:157.

the income, deductions, and credits as shown on Schedule J. Individuals

should use the information reported on the federal partnership return

Line 22 Amortization — Enter the total amount of amortization

instead of the amounts shown in the partners’ allocation schedule. Cor-

deduction for any emergency facility constructed or erected in

porations should refer to R. S. 47:287.93(A)(5).

taxable years beginning after December 31, 1955, R.S. 47:65(I),

to which the Government has issued a certificate of necessity. A

Signatures

statement of the pertinent facts should be filed with the return.

The return must be signed by any one of the partners or members. If

No amortization is permitted for the adjusted basis of a grain

receivers, trustees in bankruptcy, or assignees are in control of the prop-

storage facility or certain expenditures relating to research and

erty or business of the organization, such receivers, trustees, or assignees

experiment and trademark and trade name expenditures.

shall execute the return.

Line 23 Depletion of Mines, Oil and Gas Wells, Timber, etc. —

Any person, firm, or corporation who prepares a taxpayer’s return must

Enter the total amount of depletion of mines, oil or gas wells,

also sign. If a return is prepared by a firm or corporation, the return must

timber, etc. If complete valuation data has been submitted

be signed in the name of the firm or corporation. This verification is not

in previous years, include a statement providing an updated

required where the return is prepared by a regular, full-time employee

amount of depletion and the method of calculation.

of the taxpayer.

Line 24 Other Deductions Authorized by Law — Enter the total

amount of other authorized deductions. Do not include

items requiring separate computation and required to be

reported on Schedule J. Do not deduct losses incurred in

transactions that were neither connected with the trade or

business nor entered into for profit. No deduction is allowed

for any expense incurred to produce income not subject to

Louisiana Income Tax. If an expense is incurred in part for the

production of taxable income and in part for the production

of tax exempt income, then only the portion of the expense

that can reasonably be attributed to the production of taxable

income is deductible.

A partnership receiving any exempt income, other than

interest, or holding any property, or engaging in any activity

from which the income is exempt shall include an itemized

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11