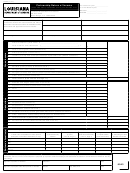

APPoRTIonmEnT oF InComE SCHEDuLE

Section C. Computation of apportionment percent

(Instructions)

2. The Salaries and Wages Factor. The Louisiana wage factor shall include

The Louisiana Income Tax Law creates a presumption that the apportionment

method of reporting must be used in the determination of the net income

the total salaries, wages, and other personal service compensation paid

where such net income is apportionable. It is mandatory that the apportion-

during the taxable year for services rendered in Louisiana in connection

ment method be used unless it can be clearly shown that the use of the

with the production of apportionable net income.

apportionment method produces a manifestly unfair result, and permission

3. The Property Factor. The Louisiana factor shall be the average of the

to use the separate accounting method is granted by the Secretary. The pro-

value of the taxpayer’s real property and tangible personal property used

portion of such income to be attributed to sources within this State should be

in the production of apportionable income within this State:

determined by means of an apportionment percent based on the factors set

a. at the beginning of the taxable year, and

forth below. The percent computed in that schedule is the arithmetic average

b. at the end of the taxable year.

of the factors applicable to your operations, which factors depend on your

principal kind of business.

4. The Loan Factor. In the case of a loan business, the Louisiana factor

The “Louisiana Factors” are as follows:

shall be the amount of loans made in this State during the period for which

1. The Sales and Charges for Services Factor. The Louisiana sales factor

the return is filed.

shall include all sales made in the regular course of business where the

5. Additional Sales Ratio. The apportionment percent of taxpayers whose

goods, merchandise, or property is received in this State by the purchaser.

net apportionable income is derived primarily from the business of manu-

In the case of delivery by common carrier or by other means of trans-

facturing or merchandising (manufacturing , producing, or sale of tangible

portation, including transportation by the purchaser, the place where the

personal property) is the arithmetical average of four factors which are

goods are ultimately received after all transportation is completed shall be

Factors 1, 2, and 3 above with Factor 1 being counted twice. This provision

considered as the place at which the goods are received by the purchaser.

does not apply to certain taxpayers engaged in the production or sale of

The Louisiana factor shall also include all charges for services performed

unrefined oil and gas, or certain taxpayers who are subject to tobacco tax.

in Louisiana.

For further information relative to these apportionment factors, see R.S. 47:245.

Section D. Apportionment factors to be used in determining income derived from sources partly within Louisiana

Not all of the following factors should be used. Your principal kind of business determines which factors apply. For air transportation, use factors (1) and (3);

for pipeline transportation, use factors (1), (2), and (3); for other transportation, use factors (1) and (3); for service enterprises in which the use of property

is not a material income-producing factor, use factors (1) and (2), otherwise, use factors (1), (2), and (3); for loan businesses, use factors (2) and (4); for

merchandising, and manufacturing, use factors (1), (2), (3) and (5); and for other businesses use factors (1), (2), and (3).

1

2

3

Total

Louisiana

Percent

Description of items used as factors

Amount

Amount

(Col 2 ÷Col 1)

1.

Net sales of merchandise and/or charges for services

.00

.00

(a)

(a) Sales where goods, merchandise, or property is received in Louisiana by the

purchaser

.00

.00

(b)

(b) Charges for services performed in Louisiana

(c) Other gross apportionable income

.00

.00

(c)

TOTAL (In Column 1, enter total net sales and charges for services; in Column 2,

%

.00

.00

enter total of Lines a, b, and c. Enter ratio in Column 3.) .....................................

2.

Wages, salaries, and other personal service compensation paid during the year

(Enter amounts in Columns 1 and 2, and ratio in Column 3.)

%

.00

.00

3.

Income tax proper ty factor ratio

%

.00

.00

4.

Loans made during the year

(Enter amounts in Columns 1 and 2, and ratio in Column 3.)

%

.00

.00

5.

Taxpayers primarily in the business of manufacturing or merchandising enter ratio from Line 1, Column 3

%

6.

Total percents in Column 3

%

7.

Average of percents

(Divide Line 6 by number of factors used. Use result in determining income apportioned to Louisiana on, Section A, Line 6.)

%

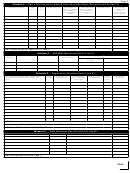

Explanation of Louisiana business

1.

Describe the nature of your business activity and specify your principle product or service, both in Louisiana and elsewhere.

Louisiana _____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

Elsewhere _____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

2.

Give address and descriptions of places of business within Louisiana ______________________________________________________________

_____________________________________________________________________________________________________________________

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11