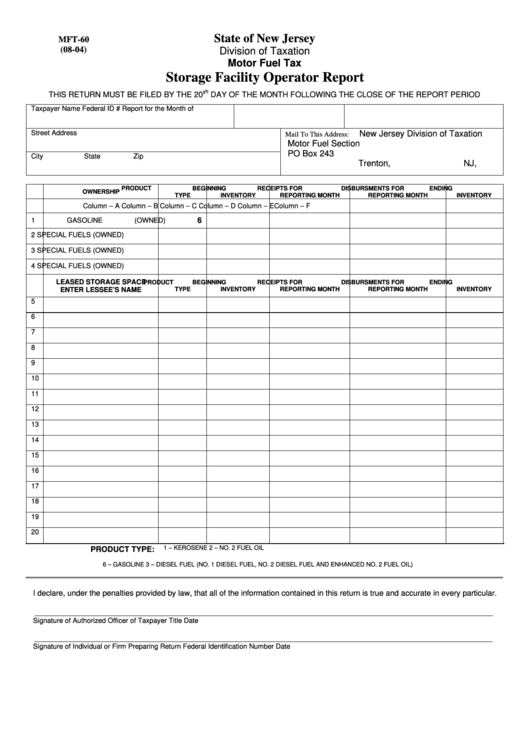

State of New Jersey

MFT-60

(08-04)

Division of Taxation

Motor Fuel Tax

Storage Facility Operator Report

yh

THIS RETURN MUST BE FILED BY THE 20

DAY OF THE MONTH FOLLOWING THE CLOSE OF THE REPORT PERIOD

Taxpayer Name

Federal ID #

Report for the Month of

Street Address

New Jersey Division of Taxation

Mail To This Address:

Motor Fuel Section

PO Box 243

City

State

Zip

Trenton, NJ, 08646-0243

PRODUCT

BEGINNING

RECEIPTS FOR

DISBURSMENTS FOR

ENDING

OWNERSHIP

TYPE

INVENTORY

REPORTING MONTH

REPORTING MONTH

INVENTORY

Column – A

Column – B

Column – C

Column – D

Column – E

Column – F

1

GASOLINE (OWNED)

6

2

SPECIAL FUELS (OWNED)

3

SPECIAL FUELS (OWNED)

4

SPECIAL FUELS (OWNED)

LEASED STORAGE SPACE

PRODUCT

BEGINNING

RECEIPTS FOR

DISBURSMENTS FOR

ENDING

ENTER LESSEE’S NAME

TYPE

INVENTORY

REPORTING MONTH

REPORTING MONTH

INVENTORY

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

1 – KEROSENE

2 – NO. 2 FUEL OIL

PRODUCT TYPE:

6 – GASOLINE

3 – DIESEL FUEL (NO. 1 DIESEL FUEL, NO. 2 DIESEL FUEL AND ENHANCED NO. 2 FUEL OIL)

I declare, under the penalties provided by law, that all of the information contained in this return is true and accurate in every particular.

_________________________________________________________________________________________________________

Signature of Authorized Officer of Taxpayer

Title

Date

_________________________________________________________________________________________________________

Signature of Individual or Firm Preparing Return

Federal Identification Number

Date

1

1 2

2