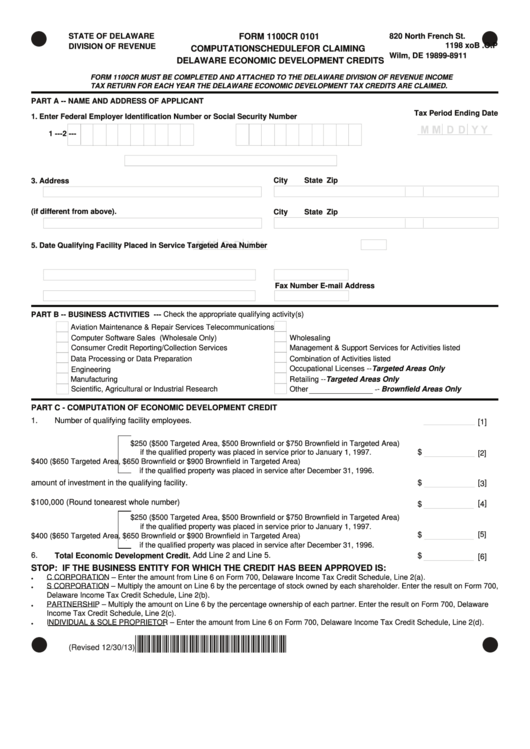

Form 1100cr 0101 - Computation Schedule For Claiming Delaware Economic Development Credits

ADVERTISEMENT

STATE OF DELAWARE

FORM 1100CR 0101

820 North French St.

. P

. O

B

o

x

8

9

1

1

DIVISION OF REVENUE

COMPUTATION SCHEDULE FOR CLAIMING

Wilm, DE 19899-8911

DELAWARE ECONOMIC DEVELOPMENT CREDITS

FORM 1100CR MUST BE COMPLETED AND ATTACHED TO THE DELAWARE DIVISION OF REVENUE INCOME

TAX RETURN FOR EACH YEAR THE DELAWARE ECONOMIC DEVELOPMENT TAX CREDITS ARE CLAIMED.

PART A -- NAME AND ADDRESS OF APPLICANT

Tax Period Ending Date

1. Enter Federal Employer Identification Number

or

Social Security Number

1 ---

2 ---

2. Name of Taxpayer

City

State Zip

3. Address

4. Location of qualifying business facility (if different from above).

City

State Zip

5. Date Qualifying Facility Placed in Service

Targeted Area Number

6. Contact Person

Telephone Number

E-mail Address

Fax Number

PART B -- BUSINESS ACTIVITIES --- Check the appropriate qualifying activity(s)

Aviation Maintenance & Repair Services

Telecommunications

Computer Software Sales (Wholesale Only)

Wholesaling

Consumer Credit Reporting/Collection Services

Management & Support Services for Activities listed

Data Processing or Data Preparation

Combination of Activities listed

Occupational Licenses -- Targeted Areas Only

Engineering

Manufacturing

Retailing -- Targeted Areas Only

Scientific, Agricultural or Industrial Research

Other

-- Brownfield Areas Only

________________

PART C - COMPUTATION OF ECONOMIC DEVELOPMENT CREDIT

1.

Number of qualifying facility employees.

[1]

$250 ($500 Targeted Area, $500 Brownfield or $750 Brownfield in Targeted Area)

$

if the qualified property was placed in service prior to January 1, 1997.

[2]

2.

Multiply Line 1 by

$400 ($650 Targeted Area, $650 Brownfield or $900 Brownfield in Targeted Area)

if the qualified property was placed in service after December 31, 1996.

3.

Enter the amount of investment in the qualifying facility.

$

[ 3 ]

4.

Divide Line 3 by $100,000 (Round to nearest whole number)

[ 4 ]

$

$250 ($500 Targeted Area, $500 Brownfield or $750 Brownfield in Targeted Area)

if the qualified property was placed in service prior to January 1, 1997.

[5]

$

5.

Multiply Line 4 by

$400 ($650 Targeted Area, $650 Brownfield or $900 Brownfield in Targeted Area)

if the qualified property was placed in service after December 31, 1996.

6.

Total Economic Development Credit. Add Line 2 and Line 5.

$

[6]

STOP: IF THE BUSINESS ENTITY FOR WHICH THE CREDIT HAS BEEN APPROVED IS:

•

C CORPORATION – Enter the amount from Line 6 on Form 700, Delaware Income Tax Credit Schedule, Line 2(a).

•

S CORPORATION – Multiply the amount on Line 6 by the percentage of stock owned by each shareholder. Enter the result on Form 700,

Delaware Income Tax Credit Schedule, Line 2(b).

•

PARTNERSHIP – Multiply the amount on Line 6 by the percentage ownership of each partner. Enter the result on Form 700, Delaware

Income Tax Credit Schedule, Line 2(c).

•

INDIVIDUAL & SOLE PROPRIETOR – Enter the amount from Line 6 on Form 700, Delaware Income Tax Credit Schedule, Line 2(d).

*DF12014019999*

(Revised 12/30/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2