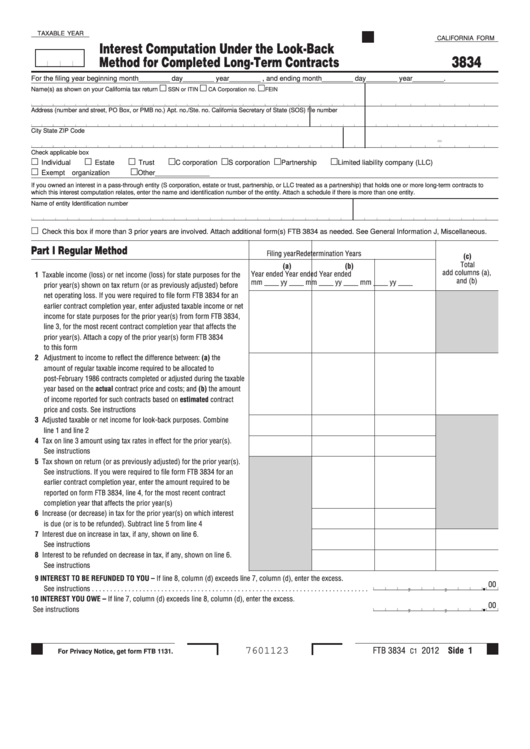

TAXABLE YEAR

CALIFORNIA FORM

Interest Computation Under the Look-Back

3834

Method for Completed Long-Term Contracts

For the filing year beginning month________ day________ year________ , and ending month________ day________ year________.

Name(s) as shown on your California tax return

SSN or ITIN

CA Corporation no.

FEIN

Address (number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

California Secretary of State (SOS) file number

City

State

ZIP Code

-

Check applicable box

Individual

Estate

Trust

C corporation

S corporation

Partnership

Limited liability company (LLC)

Exempt organization

Other______________

If you owned an interest in a pass-through entity (S corporation, estate or trust, partnership, or LLC treated as a partnership) that holds one or more long-term contracts to

which this interest computation relates, enter the name and identification number of the entity. Attach a schedule if there is more than one entity.

Name of entity

Identification number

Check this box if more than 3 prior years are involved. Attach additional form(s) FTB 3834 as needed. See General Information J, Miscellaneous.

Part I

Regular Method

Filing year

Redetermination Years

(c)

Total

(a)

(b)

add columns (a),

Year ended

Year ended

Year ended

1 Taxable income (loss) or net income (loss) for state purposes for the

and (b)

mm ____ yy ____

mm ____ yy ____

mm ____ yy ____

prior year(s) shown on tax return (or as previously adjusted) before

net operating loss. If you were required to file form FTB 3834 for an

earlier contract completion year, enter adjusted taxable income or net

income for state purposes for the prior year(s) from form FTB 3834,

line 3, for the most recent contract completion year that affects the

prior year(s). Attach a copy of the prior year(s) form FTB 3834

to this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Adjustment to income to reflect the difference between: (a) the

amount of regular taxable income required to be allocated to

post-February 1986 contracts completed or adjusted during the taxable

year based on the actual contract price and costs; and (b) the amount

of income reported for such contracts based on estimated contract

price and costs. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Adjusted taxable or net income for look-back purposes. Combine

line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Tax on line 3 amount using tax rates in effect for the prior year(s).

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Tax shown on return (or as previously adjusted) for the prior year(s).

See instructions. If you were required to file form FTB 3834 for an

earlier contract completion year, enter the amount required to be

reported on form FTB 3834, line 4, for the most recent contract

completion year that affects the prior year(s). . . . . . . . . . . . . . . . . . .

6 Increase (or decrease) in tax for the prior year(s) on which interest

is due (or is to be refunded). Subtract line 5 from line 4 . . . . . . . . . .

7 Interest due on increase in tax, if any, shown on line 6.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Interest to be refunded on decrease in tax, if any, shown on line 6.

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 INTEREST TO BE REFUNDED TO YOU – If line 8, column (d) exceeds line 7, column (d), enter the excess.

00

.

,

,

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 INTEREST YOU OWE – If line 7, column (d) exceeds line 8, column (d), enter the excess.

00

.

,

,

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FTB 3834

2012 Side 1

7601123

C1

For Privacy Notice, get form FTB 1131.

1

1 2

2