*138280200*

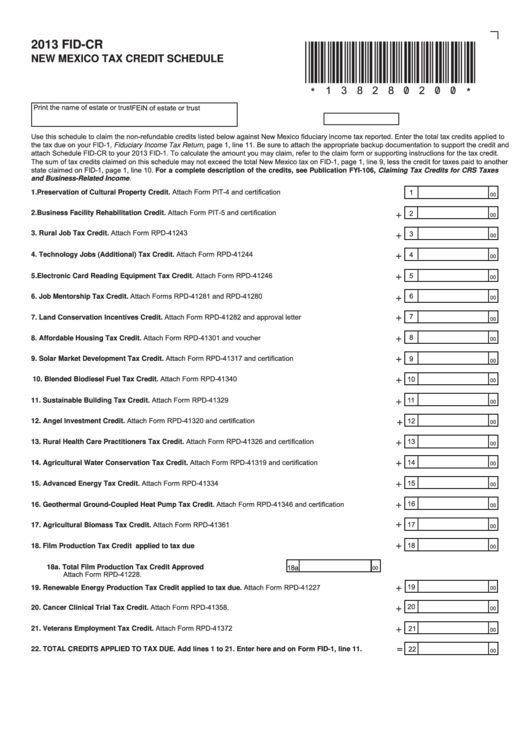

2013 FID-CR

NEW MEXICO TAX CREDIT SCHEDULE

Print the name of estate or trust

FEIN of estate or trust

Use this schedule to claim the non-refundable credits listed below against New Mexico fiduciary income tax reported. Enter the total tax credits applied to

the tax due on your FID-1, Fiduciary Income Tax Return, page 1, line 11. Be sure to attach the appropriate backup documentation to support the credit and

attach Schedule FID-CR to your 2013 FID-1. To calculate the amount you may claim, refer to the claim form or supporting instructions for the tax credit.

The sum of tax credits claimed on this schedule may not exceed the total New Mexico tax on FID-1, page 1, line 9, less the credit for taxes paid to another

state claimed on FID-1, page 1, line 10. For a complete description of the credits, see Publication FYI-106, Claiming Tax Credits for CRS Taxes

and Business-Related Income.

Preservation of Cultural Property Credit. Attach Form PIT-4 and certification ..................................................

1

1.

00

Business Facility Rehabilitation Credit. Attach Form PIT-5 and certification ....................................................

2

2.

+

00

Rural Job Tax Credit. Attach Form RPD-41243 ...................................................................................................

3

3.

+

00

Technology Jobs (Additional) Tax Credit. Attach Form RPD-41244 .................................................................

4

+

4.

00

Electronic Card Reading Equipment Tax Credit. Attach Form RPD-41246 ......................................................

5

+

5.

00

Job Mentorship Tax Credit. Attach Forms RPD-41281 and RPD-41280 ............................................................

6

+

6.

00

7

Land Conservation Incentives Credit. Attach Form RPD-41282 and approval letter .........................................

+

7.

00

Affordable Housing Tax Credit. Attach Form RPD-41301 and voucher..............................................................

8

+

8.

00

Solar Market Development Tax Credit. Attach Form RPD-41317 and certification.............................................

+

9

9.

00

10. Blended Biodiesel Fuel Tax Credit. Attach Form RPD-41340.............................................................................

10

+

00

11. Sustainable Building Tax Credit. Attach Form RPD-41329 ................................................................................

11

+

00

12. Angel Investment Credit. Attach Form RPD-41320 and certification ..................................................................

12

+

00

13. Rural Health Care Practitioners Tax Credit. Attach Form RPD-41326 and certification ....................................

13

+

00

14

14. Agricultural Water Conservation Tax Credit. Attach Form RPD-41319 and certification...................................

+

00

15. Advanced Energy Tax Credit. Attach Form RPD-41334 .....................................................................................

15

+

00

16

16. Geothermal Ground-Coupled Heat Pump Tax Credit. Attach Form RPD-41346 and certification ....................

+

00

+

17. Agricultural Biomass Tax Credit. Attach Form RPD-41361................................................................................

17

00

+

18

18. Film Production Tax Credit applied to tax due ................................................................................................

00

18a

18a. Total Film Production Tax Credit Approved ........................................

00

Attach Form RPD-41228.

19

19. Renewable Energy Production Tax Credit applied to tax due. Attach Form RPD-41227 ................................

+

00

20

20. Cancer Clinical Trial Tax Credit. Attach Form RPD-41358. ................................................................................

+

00

21. Veterans Employment Tax Credit. Attach Form RPD-41372 ..............................................................................

21

+

00

=

22

22. TOTAL CREDITS APPLIED TO TAX DUE. Add lines 1 to 21. Enter here and on Form FID-1, line 11. ...........

00

1

1