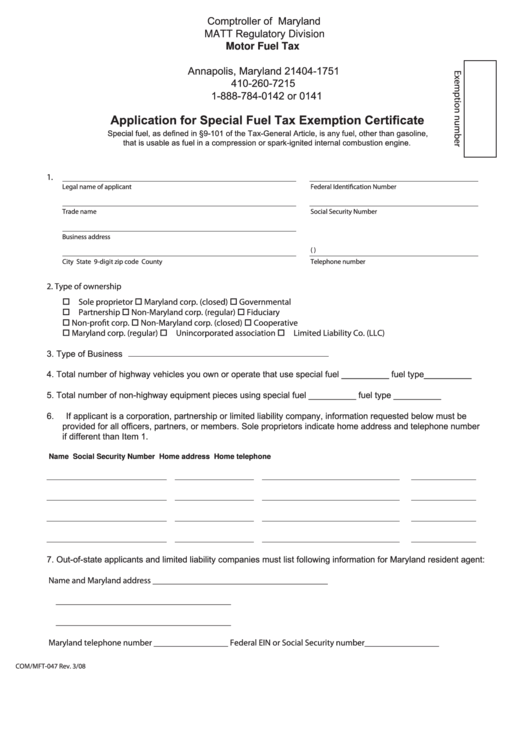

Comptroller of Maryland

MATT Regulatory Division

Motor Fuel Tax

P.O. Box 1751

Annapolis, Maryland 21404-1751

410-260-7215

1-888-784-0142 or 0141

Application for Special Fuel Tax Exemption Certificate

Special fuel, as defined in §9-101 of the Tax-General Article, is any fuel, other than gasoline,

that is usable as fuel in a compression or spark-ignited internal combustion engine.

1.

Legal name of applicant

Federal Identification Number

Trade name

Social Security Number

Business address

(

)

City

State

9-digit zip code

County

Telephone number

2. Type of ownership

Sole proprietor

Maryland corp. (closed)

Governmental

Partnership

Non-Maryland corp. (regular)

Fiduciary

Non-profit corp.

Non-Maryland corp. (closed)

Cooperative

Maryland corp. (regular)

Unincorporated association

Limited Liability Co. (LLC)

3. Type of Business

4. Total number of highway vehicles you own or operate that use special fuel __________ fuel type__________

5. Total number of non-highway equipment pieces using special fuel __________ fuel type __________

6.

If applicant is a corporation, partnership or limited liability company, information requested below must be

provided for all officers, partners, or members. Sole proprietors indicate home address and telephone number

if different than Item 1.

Name

Social Security Number

Home address

Home telephone

7. Out-of-state applicants and limited liability companies must list following information for Maryland resident agent:

Name and Maryland address ________________________________________

________________________________________

________________________________________

Maryland telephone number _________________ Federal EIN or Social Security number_________________

COM/MFT-047 Rev. 3/08

1

1 2

2