Form Rv-F1304401 - Tennessee Sales Or Use Tax Certification Of Interstate Delivery By Seller For Automobiles, Other Motor Vehicles, Aircraft, Trailers And Boats

ADVERTISEMENT

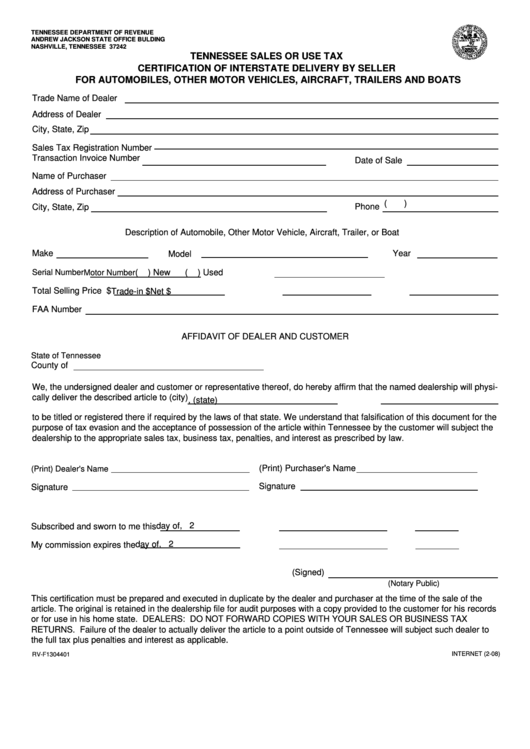

TENNESSEE DEPARTMENT OF REVENUE

ANDREW JACKSON STATE OFFICE BULDING

NASHVILLE, TENNESSEE 37242

TENNESSEE SALES OR USE TAX

CERTIFICATION OF INTERSTATE DELIVERY BY SELLER

FOR AUTOMOBILES, OTHER MOTOR VEHICLES, AIRCRAFT, TRAILERS AND BOATS

Trade Name of Dealer

Address of Dealer

City, State, Zip

Sales Tax Registration Number

Transaction Invoice Number

Date of Sale

Name of Purchaser

Address of Purchaser

Phone (

)

City, State, Zip

Description of Automobile, Other Motor Vehicle, Aircraft, Trailer, or Boat

Make

Year

Model

(

) New

(

) Used

Serial Number

Motor Number

Total Selling Price $

Trade-in $

Net $

FAA Number

AFFIDAVIT OF DEALER AND CUSTOMER

State of Tennessee

County of

We, the undersigned dealer and customer or representative thereof, do hereby affirm that the named dealership will physi-

cally deliver the described article to (city)

, (state)

to be titled or registered there if required by the laws of that state. We understand that falsification of this document for the

purpose of tax evasion and the acceptance of possession of the article within Tennessee by the customer will subject the

dealership to the appropriate sales tax, business tax, penalties, and interest as prescribed by law.

(Print) Purchaser's Name

(Print) Dealer's Name

Signature

Signature

day of

, 2

Subscribed and sworn to me this

day of

, 2

My commission expires the

(Signed)

(Notary Public)

This certification must be prepared and executed in duplicate by the dealer and purchaser at the time of the sale of the

articl

The original is retained in the dealership file for audit purposes with a copy provided to the customer for his records

e.

or for use in his home state. DEALERS: DO NOT FORWARD COPIES WITH YOUR SALES OR BUSINESS TAX

RETURNS. Failure of the dealer to actually deliver the article to a point outside of Tennessee will subject such dealer to

the full tax plus penalties and interest as applicable.

INTERNET (2-08)

RV-F1304401

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1