Form Cnf-120tc - West Virginia Summary Of Corporation Net Income Tax/ Business Franchise Tax Credits - 2011

ADVERTISEMENT

2011

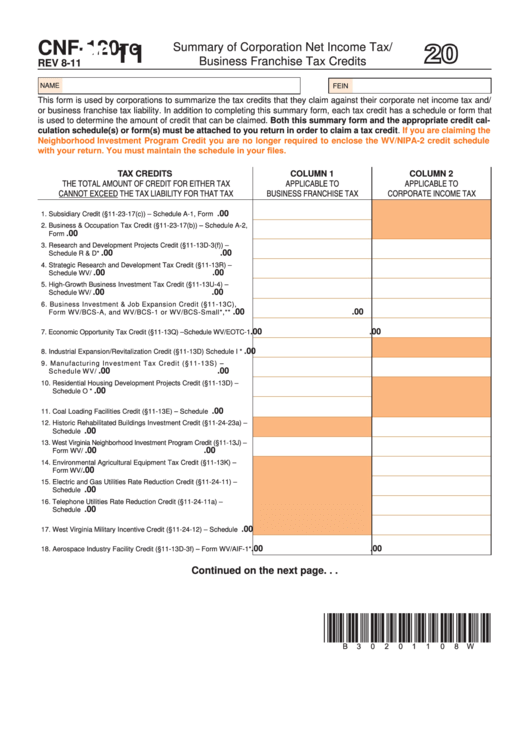

CNF-120

Summary of Corporation Net Income Tax/

TC

Business Franchise Tax Credits

REV 8-11

NaME

FEIN

This form is used by corporations to summarize the tax credits that they claim against their corporate net income tax and/

or business franchise tax liability. In addition to completing this summary form, each tax credit has a schedule or form that

is used to determine the amount of credit that can be claimed. both this summary form and the appropriate credit cal-

culation schedule(s) or form(s) must be attached to you return in order to claim a tax credit.

if you are claiming the

Neighborhood investment Program Credit you are no longer required to enclose the WV/NiPA-2 credit schedule

with your return. You must maintain the schedule in your files.

TAx CREDiTS

COLUMN 1

COLUMN 2

THE TOTAL AMOUNT OF CREDIT FOR EITHER TAX

APPLICABLE TO

APPLICABLE TO

CANNOT EXCEED THE TAX LIABILITY FOR THAT TAX

BUSINESS FRANCHISE TAX

CORPORATE INCOME TAX

.00

1. Subsidiary Credit (§11-23-17(c)) – Schedule a-1, Form CNF-120.....

2. Business & Occupation Tax Credit (§11-23-17(b)) – Schedule a-2,

.00

Form CNF-120....................................................................................

3. Research and development Projects Credit (§11-13d-3(f)) –

.00

.00

Schedule R & d*................................................................................

4. Strategic Research and development Tax Credit (§11-13R) –

.00

.00

Schedule WV/SRdTC-1.....................................................................

5. High-Growth Business Investment Tax Credit (§11-13u-4) –

.00

.00

Schedule WV/HGBITC-1....................................................................

6. Business Investment & Job Expansion Credit (§11-13C),

.00

.00

Form WV/BCS-a, and WV/BCS-1 or WV/BCS-Small*,**.........

.00

.00

7. Economic Opportunity Tax Credit (§11-13Q) –Schedule WV/EOTC-1

.00

8. Industrial Expansion/Revitalization Credit (§11-13d) Schedule I *....

9. Manufacturing Investment Tax Credit (§11-13S) –

.00

.00

Schedule WV/MITC-1.....................................................

10. Residential Housing development Projects Credit (§11-13d) –

.00

Schedule O *....................................................................................

.00

11. Coal Loading Facilities Credit (§11-13E) – Schedule C...................

12. Historic Rehabilitated Buildings Investment Credit (§11-24-23a) –

.00

Schedule RBIC................................................................................

13. West Virginia Neighborhood Investment Program Credit (§11-13J) –

.00

.00

Form WV/NIPa-2.............................................................................

14. Environmental agricultural Equipment Tax Credit (§11-13K) –

.00

Form WV/aG-1.................................................................................

15. Electric and Gas utilities Rate Reduction Credit (§11-24-11) –

.00

Schedule L.......................................................................................

16. Telephone utilities Rate Reduction Credit (§11-24-11a) –

.00

Schedule K.......................................................................................

.00

17. West Virginia Military Incentive Credit (§11-24-12) – Schedule J....

.00

.00

18. aerospace Industry Facility Credit (§11-13d-3f) – Form WV/aIF-1*

Continued on the next page. . .

*B30201108W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2