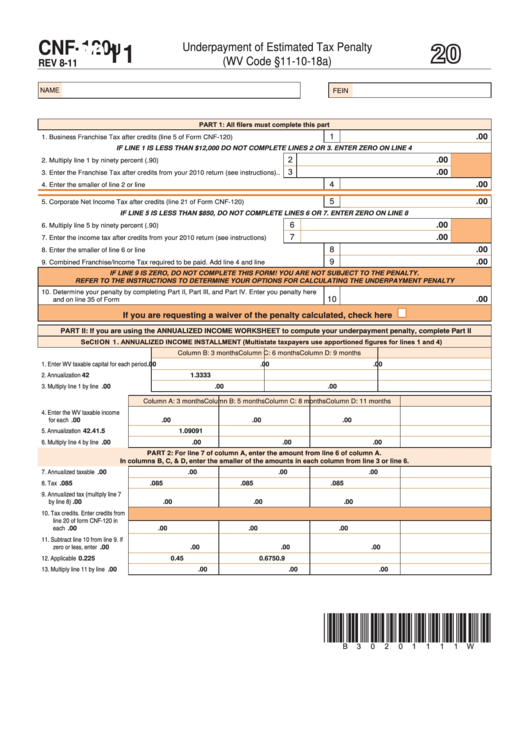

Form Cnf-120u - West Virginia Underpayment Of Estimated Tax Penalty - 2011

ADVERTISEMENT

2011

CNF-120

underpayment of Estimated Tax Penalty

U

(WV Code §11-10-18a)

REV 8-11

NaME

FEIN

PART 1: All filers must complete this part

1

.00

1. Business Franchise Tax after credits (line 5 of Form CNF-120)...............................................

IF LINE 1 IS LESS THAN $12,000 DO NOT COMPLETE LINES 2 OR 3. ENTER ZERO ON LINE 4

2

.00

2. Multiply line 1 by ninety percent (.90).................................................................

3

.00

3. Enter the Franchise Tax after credits from your 2010 return (see instructions)..

4

.00

4. Enter the smaller of line 2 or line 3..........................................................................................

5

.00

5. Corporate Net Income Tax after credits (line 21 of Form CNF-120).........................................

IF LINE 5 IS LESS THAN $850, DO NOT COMPLETE LINES 6 OR 7. ENTER ZERO ON LINE 8

6

.00

6. Multiply line 5 by ninety percent (.90).................................................................

7

.00

7. Enter the income tax after credits from your 2010 return (see instructions).......

8

.00

8. Enter the smaller of line 6 or line 7..........................................................................................

9

.00

9. Combined Franchise/Income Tax required to be paid. add line 4 and line 8...........................

IF LINE 9 IS ZERO, DO NOT COMPLETE THIS FORM! YOU ARE NOT SUBJECT TO THE PENALTY.

REFER TO THE INSTRUCTIONS TO DETERMINE YOUR OPTIONS FOR CALCULATING THE UNDERPAYMENT PENALTY

10. determine your penalty by completing Part II, Part III, and Part IV. Enter you penalty here

10

.00

and on line 35 of Form CNF-120............................................................................................

if you are requesting a waiver of the penalty calculated, check here

PART ii: if you are using the ANNUALiZED iNCOME WORKSHEET to compute your underpayment penalty, complete Part ii

SeCtION 1. ANNUALIZED INCOME INSTALLMENT (Multistate taxpayers use apportioned figures for lines 1 and 4)

Column B: 3 months

Column C: 6 months

Column d: 9 months

1. Enter WV taxable capital for each period

.00

.00

.00

2. Annualization amounts.............................

4

2

1.3333

3. Multiply line 1 by line 2.............................

.00

.00

.00

Column a: 3 months

Column B: 5 months

Column C: 8 months

Column d: 11 months

4. Enter the WV taxable income

for each period..........................

.00

.00

.00

.00

5. Annualization amounts..............

4

2.4

1.5

1.09091

6. Multiply line 4 by line 5..............

.00

.00

.00

.00

PART 2: For line 7 of column A, enter the amount from line 6 of column A.

in columns b, C, & D, enter the smaller of the amounts in each column from line 3 or line 6.

7. Annualized taxable income........

.00

.00

.00

.00

8. Tax rate......................................

.085

.085

.085

.085

9. Annualized tax (multiply line 7

by line 8)...................................

.00

.00

.00

.00

10. Tax credits. Enter credits from

line 20 of form CNF-120 in

each column...........................

.00

.00

.00

.00

11. Subtract line 10 from line 9. If

zero or less, enter 0...............

.00

.00

.00

.00

12. Applicable percentage.............

0.225

0.45

0.675

0.9

13. Multiply line 11 by line 12........

.00

.00

.00

.00

*B30201111W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3