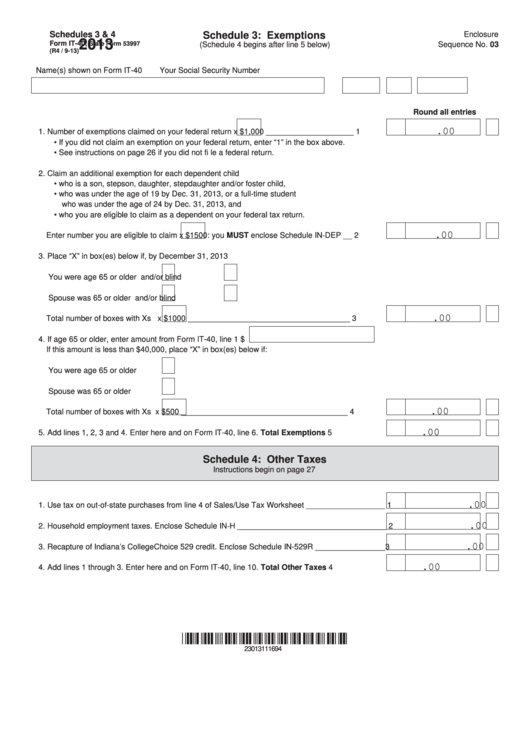

Schedules 3 & 4

Schedule 3: Exemptions

Enclosure

2013

Form IT-40,

State Form 53997

(Schedule 4 begins after line 5 below)

Sequence No. 03

(R4 / 9-13)

Name(s) shown on Form IT-40

Your Social Security Number

Round all entries

.00

1. Number of exemptions claimed on your federal return

x $1,000 ____________________

1

• If you did not claim an exemption on your federal return, enter “1” in the box above.

• See instructions on page 26 if you did not fi le a federal return.

2. Claim an additional exemption for each dependent child

• who is a son, stepson, daughter, stepdaughter and/or foster child,

• who was under the age of 19 by Dec. 31, 2013, or a full-time student

who was under the age of 24 by Dec. 31, 2013, and

• who you are eligible to claim as a dependent on your federal tax return.

.00

Enter number you are eligible to claim

x $1500: you MUST enclose Schedule IN-DEP __

2

3. Place “X” in box(es) below if, by December 31, 2013

You were age 65 or older

and/or blind

Spouse was 65 or older

and/or blind

.00

Total number of boxes with Xs

x $1000 _____________________________________

3

4. If age 65 or older, enter amount from Form IT-40, line 1 $

If this amount is less than $40,000, place “X” in box(es) below if:

You were age 65 or older

Spouse was 65 or older

.00

Total number of boxes with Xs

x $500 ______________________________________

4

.00

5. Add lines 1, 2, 3 and 4. Enter here and on Form IT-40, line 6.

Total Exemptions

5

Schedule 4: Other Taxes

Instructions begin on page 27

.00

1. Use tax on out-of-state purchases from line 4 of Sales/Use Tax Worksheet __________________

1

.00

2. Household employment taxes. Enclose Schedule IN-H __________________________________

2

.00

3. Recapture of Indiana’s CollegeChoice 529 credit. Enclose Schedule IN-529R ________________

3

.00

4. Add lines 1 through 3. Enter here and on Form IT-40, line 10.

Total Other Taxes

4

23013111694

1

1