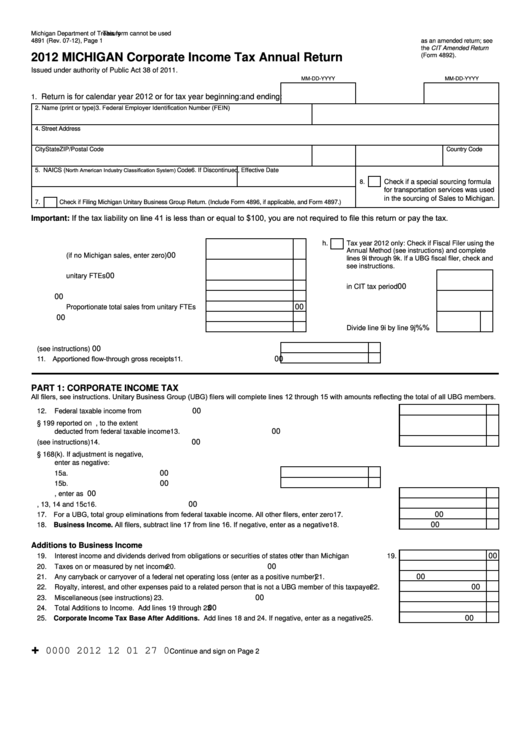

Form 4891 - Michigan Corporate Income Tax Annual Return - 2012

ADVERTISEMENT

Michigan Department of Treasury

This form cannot be used

4891 (Rev. 07-12), Page 1

as an amended return; see

the CIT Amended Return

2012 MICHIGAN Corporate Income Tax Annual Return

(Form 4892).

Issued under authority of Public Act 38 of 2011.

MM-DD-YYYY

MM-DD-YYYY

Return is for calendar year 2012 or for tax year beginning:

and ending:

1.

3. Federal Employer Identification Number (FEIN)

2. Name (print or type)

4. Street Address

City

State

ZIP/Postal Code

Country Code

North American Industry Classification System)

5. NAICS (

Code

6. If Discontinued, Effective Date

8.

Check if a special sourcing formula

for transportation services was used

in the sourcing of Sales to Michigan.

7.

Check if Filing Michigan Unitary Business Group Return. (Include Form 4896, if applicable, and Form 4897.)

Important: If the tax liability on line 41 is less than or equal to $100, you are not required to file this return or pay the tax.

9. Apportionment Calculation

h.

Tax year 2012 only: Check if Fiscal Filer using the

a. Michigan sales of the corporation

Annual Method (see instructions) and complete

00

(if no Michigan sales, enter zero) ..................

lines 9i through 9k. If a UBG fiscal filer, check and

see instructions.

b. Proportionate Michigan sales from

00

unitary FTEs ..................................................

i. Number of months

00

c. Michigan sales. Add lines 9a and 9b .............

in CIT tax period ...................

00

d. Total sales of the corporation.........................

00

e. Proportionate total sales from unitary FTEs ....

j. Total months .........................

00

f. Total sales. Add lines 9d and 9e ....................

k. Proration Percentage.

%

%

g. Apportionment percentage. Divide 9c by 9f...

Divide line 9i by line 9j ..........

00

10. Gross receipts from corporate activity (see instructions).................... 10.

11. Apportioned flow-through gross receipts .............................................

00

11.

PART 1: CORPORATE INCOME TAX

All filers, see instructions. Unitary Business Group (UBG) filers will complete lines 12 through 15 with amounts reflecting the total of all UBG members.

00

12. Federal taxable income from U.S. Form 1120..................................................................................................

12.

13. Domestic Production Activities deduction based on IRC § 199 reported on U.S. Form 8903, to the extent

00

deducted from federal taxable income ............................................................................................................

13.

00

14. Miscellaneous (see instructions) .....................................................................................................................

14.

15. Adjustments due to decoupling of Michigan depreciation from IRC § 168(k). If adjustment is negative,

enter as negative:

00

a. Net bonus depreciation adjustment ............................................. 15a.

00

b. Gain/loss adjustment on sale of an eligible depreciable asset .... 15b.

00

c. Add lines 15a and 15b. If negative, enter as negative.............................................................................. 15c.

00

16. Add lines 12, 13, 14 and 15c ...........................................................................................................................

16.

17. For a UBG, total group eliminations from federal taxable income. All other filers, enter zero .........................

00

17.

18. Business Income. All filers, subtract line 17 from line 16. If negative, enter as a negative ...........................

00

18.

Additions to Business Income

00

19. Interest income and dividends derived from obligations or securities of states other than Michigan ................

19.

00

20. Taxes on or measured by net income ..............................................................................................................

20.

00

21. Any carryback or carryover of a federal net operating loss (enter as a positive number) .................................

21.

00

22. Royalty, interest, and other expenses paid to a related person that is not a UBG member of this taxpayer ....

22.

00

23. Miscellaneous (see instructions) .....................................................................................................................

23.

00

24. Total Additions to Income. Add lines 19 through 23.........................................................................................

24.

00

25. Corporate Income Tax Base After Additions. Add lines 18 and 24. If negative, enter as a negative .........

25.

+

0000 2012 12 01 27 0

Continue and sign on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9