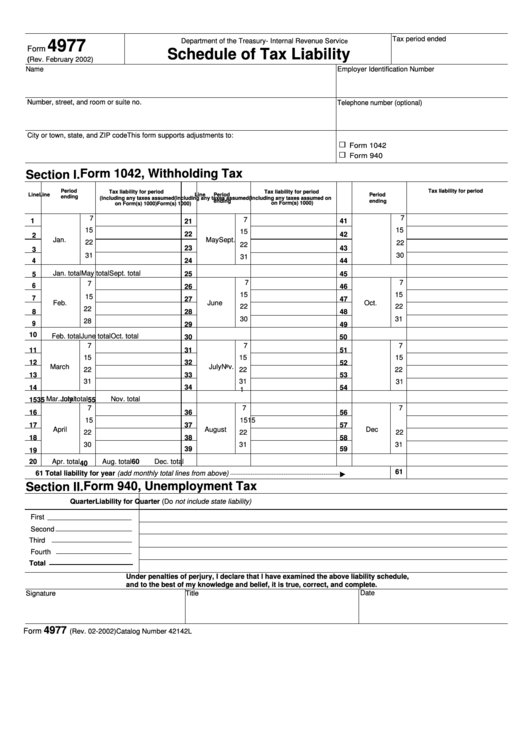

Tax period ended

Department of the Treasury- Internal Revenue Servic

e

4977

Form

Schedule of Tax Liability

(Rev. February 2002)

Name

Employer Identification Number

Number, street, and room or suite no.

Telephone number (optional)

City or town, state, and ZIP code

This form supports adjustments to:

Form 1042

Form 940

Form 1042, Withholding Tax

Section I.

Period

Tax liability for period

Tax liability for period

Tax liability for period

Line

Line

Line

Period

Period

ending

(including any taxes assumed

(including any taxes assumed

(including any taxes assumed on

No.

No.

ending

No.

ending

on Form(s) 1000)

on Form(s) 1000)

Form(s) 1000)

7

7

7

1

21

41

15

15

15

22

42

2

Jan.

May

Sept.

22

22

22

23

43

3

30

31

31

4

24

44

Jan. total

May total

Sept. total

25

45

5

7

7

7

6

26

46

15

15

15

7

27

47

Feb.

June

Oct.

22

22

22

8

28

48

30

31

28

9

29

49

10

Feb. total

June total

Oct. total

30

50

7

7

7

11

31

51

15

15

15

12

32

52

March

July

Nov.

22

22

22

13

33

53

31

31

31

34

14

54

1

Mar. total

July total

Nov. total

15

35

55

7

7

7

16

36

56

15

15

15

17

37

57

April

August

Dec

22

22

22

18

38

58

30

31

31

39

59

19

20

Apr. total

Aug. total

60

Dec. total

40

61

61 Total liability for year (add monthly total lines from above)

Form 940, Unemployment Tax

Section II.

Quarter

Liability for Quarter (Do not include state liability)

First

Second

Third

Fourth

Total

Under penalties of perjury, I declare that I have examined the above liability schedule,

and to the best of my knowledge and belief, it is true, correct, and complete.

Signature

Title

Date

4977

Form

Catalog Number 42142L

(Rev. 02-2002)

1

1