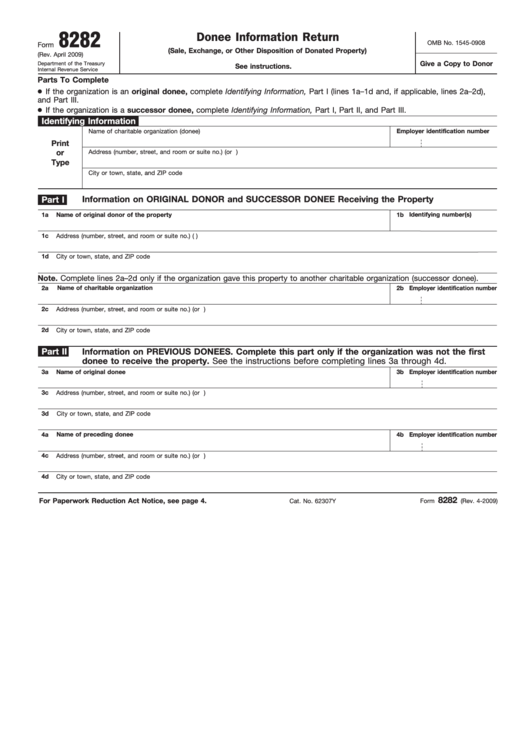

8282

Donee Information Return

OMB No. 1545-0908

Form

(Sale, Exchange, or Other Disposition of Donated Property)

(Rev. April 2009)

Give a Copy to Donor

Department of the Treasury

See instructions.

Internal Revenue Service

Parts To Complete

If the organization is an original donee, complete Identifying Information, Part I (lines 1a–1d and, if applicable, lines 2a–2d),

and Part III.

If the organization is a successor donee, complete Identifying Information, Part I, Part II, and Part III.

Identifying Information

Name of charitable organization (donee)

Employer identification number

Print

Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

or

Type

City or town, state, and ZIP code

Information on ORIGINAL DONOR and SUCCESSOR DONEE Receiving the Property

Part I

1a

Name of original donor of the property

1b

Identifying number(s)

1c

Address (number, street, and room or suite no.) (P.O. box no. if mail is not delivered to the street address)

1d

City or town, state, and ZIP code

Note. Complete lines 2a–2d only if the organization gave this property to another charitable organization (successor donee).

2a

Name of charitable organization

2b

Employer identification number

2c

Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

2d

City or town, state, and ZIP code

Part II

Information on PREVIOUS DONEES. Complete this part only if the organization was not the first

donee to receive the property. See the instructions before completing lines 3a through 4d.

3a

Name of original donee

3b

Employer identification number

3c

Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

3d

City or town, state, and ZIP code

4a

Name of preceding donee

4b

Employer identification number

4c

Address (number, street, and room or suite no.) (or P.O. box no. if mail is not delivered to the street address)

4d

City or town, state, and ZIP code

8282

For Paperwork Reduction Act Notice, see page 4.

Cat. No. 62307Y

Form

(Rev. 4-2009)

1

1 2

2 3

3 4

4