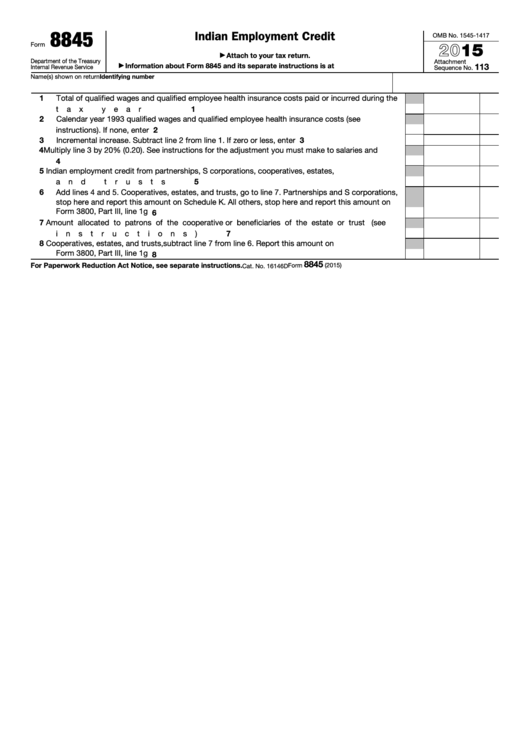

8845

Indian Employment Credit

OMB No. 1545-1417

2015

Form

Attach to your tax return.

▶

Department of the Treasury

Attachment

Information about Form 8845 and its separate instructions is at

113

▶

Internal Revenue Service

Sequence No.

Name(s) shown on return

Identifying number

1

Total of qualified wages and qualified employee health insurance costs paid or incurred during the

tax year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Calendar year 1993 qualified wages and qualified employee health insurance costs (see

instructions). If none, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Incremental increase. Subtract line 2 from line 1. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

3

4

Multiply line 3 by 20% (0.20). See instructions for the adjustment you must make to salaries and

wages .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Indian

employment

credit

from

partnerships,

S

corporations,

cooperatives,

estates,

5

and trusts .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Add lines 4 and 5. Cooperatives, estates, and trusts, go to line 7. Partnerships and S corporations,

stop here and report this amount on Schedule K. All others, stop here and report this amount on

Form 3800, Part III, line 1g .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

(see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Cooperatives, estates, and trusts, subtract line 7 from line 6. Report this amount on

Form 3800, Part III, line 1g .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

8845

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2015)

Cat. No. 16146D

1

1