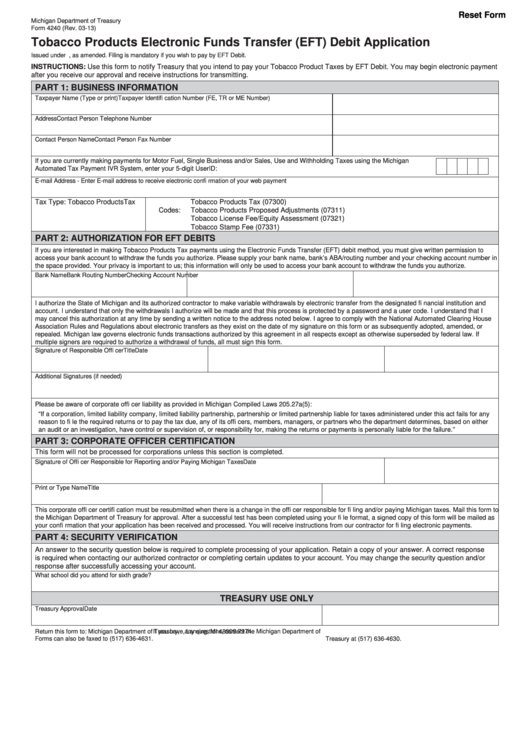

Reset Form

Michigan Department of Treasury

Form 4240 (Rev. 03-13)

Tobacco Products Electronic Funds Transfer (EFT) Debit Application

Issued under P.A. 122 of 1941, as amended. Filing is mandatory if you wish to pay by EFT Debit.

INSTRUCTIONS: Use this form to notify Treasury that you intend to pay your Tobacco Product Taxes by EFT Debit. You may begin electronic payment

after you receive our approval and receive instructions for transmitting.

PART 1: BUSINESS INFORMATION

Taxpayer Name (Type or print)

Taxpayer Identifi cation Number (FE, TR or ME Number)

Address

Contact Person Telephone Number

Contact Person Name

Contact Person Fax Number

If you are currently making payments for Motor Fuel, Single Business and/or Sales, Use and Withholding Taxes using the Michigan

Automated Tax Payment IVR System, enter your 5-digit UserID:

E-mail Address - Enter E-mail address to receive electronic confi rmation of your web payment

Tax Type: Tobacco Products

Tax

Tobacco Products Tax (07300)

Codes:

Tobacco Products Proposed Adjustments (07311)

Tobacco License Fee/Equity Assessment (07321)

Tobacco Stamp Fee (07331)

PART 2: AUTHORIZATION FOR EFT DEBITS

If you are interested in making Tobacco Products Tax payments using the Electronic Funds Transfer (EFT) debit method, you must give written permission to

access your bank account to withdraw the funds you authorize. Please supply your bank name, bank’s ABA/routing number and your checking account number in

the space provided. Your privacy is important to us; this information will only be used to access your bank account to withdraw the funds you authorize.

Bank Name

Bank Routing Number

Checking Account Number

I authorize the State of Michigan and its authorized contractor to make variable withdrawals by electronic transfer from the designated fi nancial institution and

account. I understand that only the withdrawals I authorize will be made and that this process is protected by a password and a user code. I understand that I

may cancel this authorization at any time by sending a written notice to the address noted below. I agree to comply with the National Automated Clearing House

Association Rules and Regulations about electronic transfers as they exist on the date of my signature on this form or as subsequently adopted, amended, or

repealed. Michigan law governs electronic funds transactions authorized by this agreement in all respects except as otherwise superseded by federal law. If

multiple signers are required to authorize a withdrawal of funds, all must sign this form.

Signature of Responsible Offi cer

Title

Date

Additional Signatures (if needed)

Please be aware of corporate offi cer liability as provided in Michigan Compiled Laws 205.27a(5):

“If a corporation, limited liability company, limited liability partnership, partnership or limited partnership liable for taxes administered under this act fails for any

reason to fi le the required returns or to pay the tax due, any of its offi cers, members, managers, or partners who the department determines, based on either

an audit or an investigation, have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure.”

PART 3: CORPORATE OFFICER CERTIFICATION

This form will not be processed for corporations unless this section is completed.

Signature of Offi cer Responsible for Reporting and/or Paying Michigan Taxes

Date

Print or Type Name

Title

This corporate offi cer certifi cation must be resubmitted when there is a change in the offi cer responsible for fi ling and/or paying Michigan taxes. Mail this form to

the Michigan Department of Treasury for approval. After a successful test has been completed using your fi le format, a signed copy of this form will be mailed as

your confi rmation that your application has been received and processed. You will receive instructions from our contractor for fi ling electronic payments.

PART 4: SECURITY VERIFICATION

An answer to the security question below is required to complete processing of your application. Retain a copy of your answer. A correct response

is required when contacting our authorized contractor or completing certain updates to your account. You may change the security question and/or

response after successfully accessing your account.

What school did you attend for sixth grade?

TREASURY USE ONLY

Treasury Approval

Date

Return this form to: Michigan Department of Treasury, P.O. Box 30474, Lansing, MI 48909-7974.

If you have any questions, contact the Michigan Department of

Forms can also be faxed to (517) 636-4631.

Treasury at (517) 636-4630.

1

1