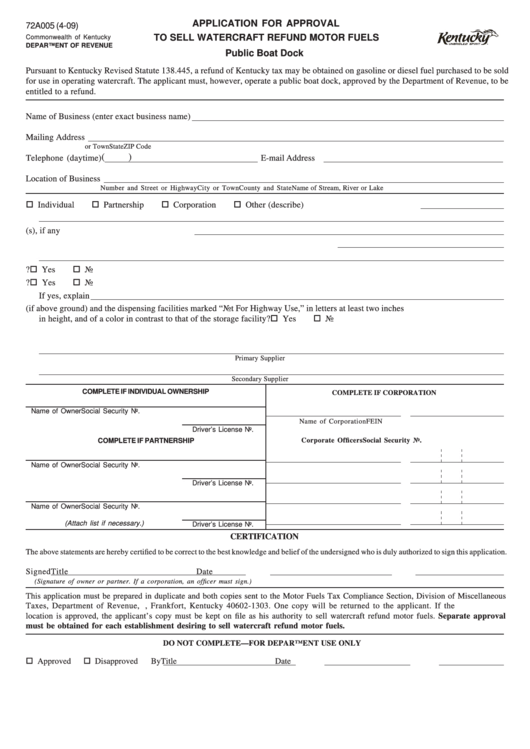

Form 72a005 - Application For Approval To Sell Watercraft Refund Motor Fuels

ADVERTISEMENT

APPLICATION FOR APPROVAL

72A005 (4-09)

TO SELL WATERCRAFT REFUND MOTOR FUELS

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Public Boat Dock

Pursuant to Kentucky Revised Statute 138.445, a refund of Kentucky tax may be obtained on gasoline or diesel fuel purchased to be sold

for use in operating watercraft. The applicant must, however, operate a public boat dock, approved by the Department of Revenue, to be

entitled to a refund.

Name of Business (enter exact business name)

Mailing Address

P.O. Box or Number and Street

City or Town

State

ZIP Code

(

)

Telephone (daytime)

E-mail Address

Location of Business

Number and Street or Highway

City or Town

County and State

Name of Stream, River or Lake

1. Indicate type of ownership

Individual

Partnership

Corporation

Other (describe)

2. Give the name of previous owner(s), if any

3. Describe the location of the dispensing units in relation to ramp or docking facilities

4. Can automobiles be fueled from these facilities?

Yes

No

5. Do you sell gasoline or diesel fuel at this location for purposes other than use in watercraft?

Yes

No

If yes, explain

6. Are the storage facilities (if above ground) and the dispensing facilities marked “Not For Highway Use,” in letters at least two inches

in height, and of a color in contrast to that of the storage facility?

Yes

No

7. Give the names and addresses of your primary and secondary suppliers of watercraft refund motor fuels.

Primary Supplier

Secondary Supplier

COMPLETE IF INDIVIDUAL OWNERSHIP

COMPLETE IF CORPORATION

Name of Owner

Social Security No.

Name of Corporation

FEIN

Driver’s License No.

Corporate Officers

Social Security No.

COMPLETE IF PARTNERSHIP

Name of Owner

Social Security No.

Driver’s License No.

Name of Owner

Social Security No.

(Attach list if necessary.)

Driver’s License No.

CERTIFICATION

The above statements are hereby certified to be correct to the best knowledge and belief of the undersigned who is duly authorized to sign this application.

Signed

Title

Date

(Signature of owner or partner. If a corporation, an officer must sign.)

This application must be prepared in duplicate and both copies sent to the Motor Fuels Tax Compliance Section, Division of Miscellaneous

Taxes, Department of Revenue, P.O. Box 1303, Frankfort, Kentucky 40602-1303. One copy will be returned to the applicant. If the

location is approved, the applicant’s copy must be kept on file as his authority to sell watercraft refund motor fuels. Separate approval

must be obtained for each establishment desiring to sell watercraft refund motor fuels.

DO NOT COMPLETE—FOR DEPARTMENT USE ONLY

Approved

Disapproved

By

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1