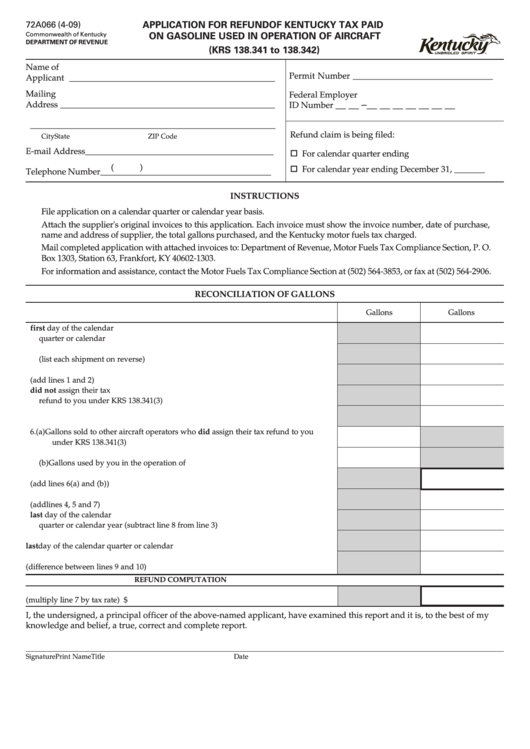

72A066 (4-09)

APPLICATION FOR REFUND OF KENTUCKY TAX PAID

Commonwealth of Kentucky

ON GASOLINE USED IN OPERATION OF AIRCRAFT

DEPARTMENT OF REVENUE

(KRS 138.341 to 138.342)

Name of

Permit Number ________________________________

Applicant _______________________________________________

Mailing

Federal Employer

Address _________________________________________________

__ __ –__ __ __ __ __ __ __

ID Number

________________________________________________________

Refund claim is being filed:

City

State

ZIP Code

E-mail Address ___________________________________________

For calendar quarter ending

(

)

For calendar year ending December 31, _______

Telephone Number _______________________________________

INSTRUCTIONS

File application on a calendar quarter or calendar year basis.

Attach the supplier's original invoices to this application. Each invoice must show the invoice number, date of purchase,

name and address of supplier, the total gallons purchased, and the Kentucky motor fuels tax charged.

Mail completed application with attached invoices to: Department of Revenue, Motor Fuels Tax Compliance Section, P. O.

Box 1303, Station 63, Frankfort, KY 40602-1303.

For information and assistance, contact the Motor Fuels Tax Compliance Section at (502) 564-3853, or fax at (502) 564-2906.

RECONCILIATION OF GALLONS

Gallons

Gallons

1. Total gallons of Kentucky tax-paid gasoline on hand the first day of the calendar

quarter or calendar year .......................................................................................................

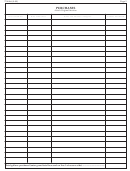

2. Total gallons of Kentucky tax-paid gasoline purchased during the quarter or year

(list each shipment on reverse) ............................................................................................

3. Total gallons available for sale or use (add lines 1 and 2) ...............................................

4. Total gallons sold to other aircraft operators who did not assign their tax

refund to you under KRS 138.341(3) ...................................................................................

5. Total gallons used by you for nonrefundable purposes ..................................................

6. (a) Gallons sold to other aircraft operators who did assign their tax refund to you

under KRS 138.341(3) ....................................................................................................

(b) Gallons used by you in the operation of aircraft ........................................................

7. Total gallons subject to refund (add lines 6(a) and (b)) ...................................................

8. Total gallons sold or used (add lines 4, 5 and 7) ...............................................................

9. Total gallons of Kentucky tax-paid gasoline on hand the last day of the calendar

quarter or calendar year (subtract line 8 from line 3) ......................................................

10. Actual gallons on hand the last day of the calendar quarter or calendar year ............

11. Inventory adjustment (difference between lines 9 and 10) .............................................

REFUND COMPUTATION

12. Gasoline tax refund due (multiply line 7 by tax rate) ......................................................

$

I, the undersigned, a principal officer of the above-named applicant, have examined this report and it is, to the best of my

knowledge and belief, a true, correct and complete report.

Signature

Print Name

Title

Date

1

1 2

2