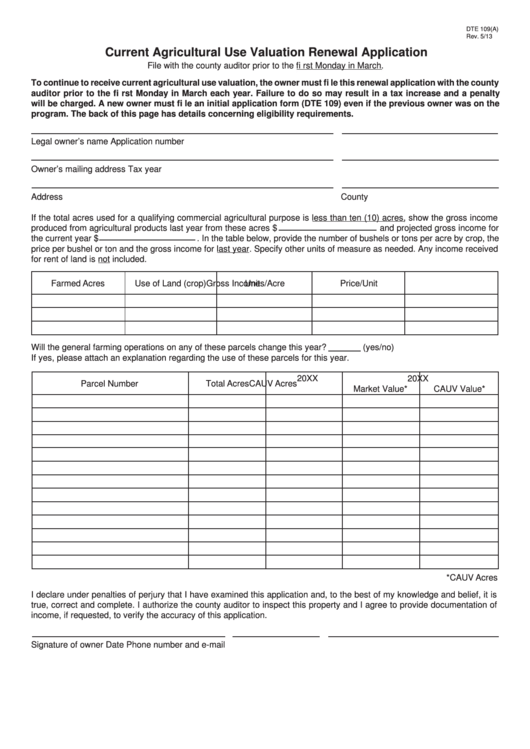

Reset Form

DTE 109(A)

Rev. 5/13

Current Agricultural Use Valuation Renewal Application

File with the county auditor prior to the fi rst Monday in March.

To continue to receive current agricultural use valuation, the owner must fi le this renewal application with the county

auditor prior to the fi rst Monday in March each year. Failure to do so may result in a tax increase and a penalty

will be charged. A new owner must fi le an initial application form (DTE 109) even if the previous owner was on the

program. The back of this page has details concerning eligibility requirements.

Legal owner’s name

Application number

Owner’s mailing address

Tax year

Address

County

If the total acres used for a qualifying commercial agricultural purpose is less than ten (10) acres, show the gross income

produced from agricultural products last year from these acres $

and projected gross income for

the current year $

. In the table below, provide the number of bushels or tons per acre by crop, the

price per bushel or ton and the gross income for last year. Specify other units of measure as needed. Any income received

for rent of land is not included.

Farmed Acres

Use of Land (crop)

Units/Acre

Price/Unit

Gross Income

Will the general farming operations on any of these parcels change this year?

(yes/no)

If yes, please attach an explanation regarding the use of these parcels for this year.

20XX

20XX

Parcel Number

Total Acres

CAUV Acres

Market Value*

CAUV Value*

*CAUV Acres

I declare under penalties of perjury that I have examined this application and, to the best of my knowledge and belief, it is

true, correct and complete. I authorize the county auditor to inspect this property and I agree to provide documentation of

income, if requested, to verify the accuracy of this application.

Signature of owner

Date

Phone number and e-mail

1

1 2

2