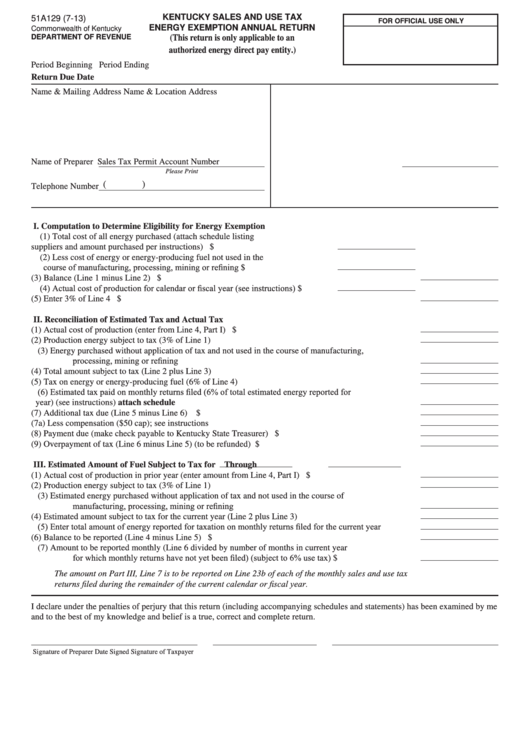

KENTUCKY SALES AND USE TAX

51A129 (7-13)

FOR OFFICIAL USE ONLY

ENERGY EXEMPTION ANNUAL RETURN

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

(This return is only applicable to an

authorized energy direct pay entity.)

Period Beginning

Period Ending

Return Due Date

Name & Mailing Address

Name & Location Address

Name of Preparer

Sales Tax Permit Account Number

Please Print

(

)

Telephone Number

I. Computation to Determine Eligibility for Energy Exemption

(1) Total cost of all energy purchased (attach schedule listing

suppliers and amount purchased per instructions) ........................................ $

(2) Less cost of energy or energy-producing fuel not used in the

course of manufacturing, processing, mining or refining ............................. $

(3) Balance (Line 1 minus Line 2) ........................................................................................................... $

(4) Actual cost of production for calendar or fiscal year (see instructions) ....... $

(5) Enter 3% of Line 4 .............................................................................................................................. $

II. Reconciliation of Estimated Tax and Actual Tax

(1) Actual cost of production (enter from Line 4, Part I) ......................................................................... $

(2) Production energy subject to tax (3% of Line 1) ................................................................................

(3) Energy purchased without application of tax and not used in the course of manufacturing,

processing, mining or refining ............................................................................................................

(4) Total amount subject to tax (Line 2 plus Line 3) ................................................................................

(5) Tax on energy or energy-producing fuel (6% of Line 4) ....................................................................

(6) Estimated tax paid on monthly returns filed (6% of total estimated energy reported for

year) (see instructions) attach schedule ...........................................................................................

(7) Additional tax due (Line 5 minus Line 6) ......................................................................................... $

(7a) Less compensation ($50 cap); see instructions .........................................................................

(8) Payment due (make check payable to Kentucky State Treasurer) ...................................................... $

(9) Overpayment of tax (Line 6 minus Line 5) (to be refunded) ............................................................. $

III. Estimated Amount of Fuel Subject to Tax for

Through

(1) Actual cost of production in prior year (enter amount from Line 4, Part I) ....................................... $

(2) Production energy subject to tax (3% of Line 1) ................................................................................

(3) Estimated energy purchased without application of tax and not used in the course of

manufacturing, processing, mining or refining ...................................................................................

(4) Estimated amount subject to tax for the current year (Line 2 plus Line 3) ........................................

(5) Enter total amount of energy reported for taxation on monthly returns filed for the current year .....

(6) Balance to be reported (Line 4 minus Line 5) .................................................................................... $

(7) Amount to be reported monthly (Line 6 divided by number of months in current year

for which monthly returns have not yet been filed) (subject to 6% use tax) ...................................... $

The amount on Part III, Line 7 is to be reported on Line 23b of each of the monthly sales and use tax

returns filed during the remainder of the current calendar or fiscal year.

I declare under the penalties of perjury that this return (including accompanying schedules and statements) has been examined by me

and to the best of my knowledge and belief is a true, correct and complete return.

Signature of Preparer

Date Signed

Signature of Taxpayer

1

1 2

2 3

3